There are many reasons to pay off debt to improve your life. But how do you do this when you are facing a mountain of debt? Let’s look at how to set up a debt snowball that actually works.

Before we dig in, let’s cover a financial truth: the most successful debt payoff plan is the one that you actually follow.

There are a multiple different ways to pay off debt:

- debt snowball

- debt avalanche

- consolidation method

In this debt payoff guide we focus on the debt snowball because it works well for most people. It’s front loaded with psychological wins and encourages people to keep going.

The debt snowball plan is a great system front-loaded with rewards and positive psychological wins that has helped millions of people pay off debt.

A Debt Payoff Planner Bundle designed to help you track the progress you are making paying off debt during your financial journey. Including:

- debt payoff planner cover, overview, and tracker pages

- debt snowball & avalanche payoff priority list setup and instructions

- debt payment trackers & 4 debt payoff coloring trackers

- debt priority list & yearly debt payoff progress tracker

What Is A Debt Snowball?

With the debt snowball method you attack debt by tackling the smallest obligation first.

You pay as much money as possible toward the smallest balance owed. When it is paid off you then roll that minimum payment and all extra money toward the next smallest balance.

You continue this process knocking off bigger and bigger debts with a larger payment amount, just like a snowball rolling down a hill.

This method was popularized by personal finance personality Dave Ramsey.

Learn more: What Are Dave Ramsey’s Baby Steps?

Why The Debt Snowball WORKS

Many math nerds call the debt snowball the worst way to repay debt. They do so because this payoff method doesn’t take interest rates into account.

What this means is that you might work on paying off a 2% interest loan just because it has the smallest balance. You will be ignoring a higher interest rate on other balances which then cost you more in the long run due to interest

Depending on your debt interest rates and loan balances, the debt snowball might not be the best mathematical choice for paying off debt.

So why does the debt snowball method work so well for people paying off debt?

It works well because the small victories people achieve up front when paying off debt. Instead of tackling a $10,000 loan balance and making little progress you’re able to completely pay off that small $500 balance quickly.

The feeling of making progress by eliminating a single debt has huge psychological ramifications. People feel more confident and are able to tackle bigger debt payoff challenges.

The debt snowball might not be the best way financially to pay off debt compared to a technique like the debt avalanche strategy, but it uses psychological strategies that work for many people.

Need some motivation? Read 111 Quotes About Paying Debts To Motivate Your Debt Free Journey

How To Set Up A Debt Snowball

Setting up a debt snowball is actually very straightforward.

There are only 5 steps to setting up and completing a debt snowball:

- Step 1: To start you will list all of your debts from smallest balance to largest balance regardless of interest rate.

- Step 2: Make minimum payments on all your debts except the smallest debt balance.

- Step 3: Pay as much as possible on your smallest debt balance until it is completely paid off.

- Step 4: Take the minimum payment from the previous loan and all your extra income and apply it to the next largest debt balance.

- Step 5: Repeat until each debt is paid in full.

There are many examples online of setting up a debt snowball to repay debts.

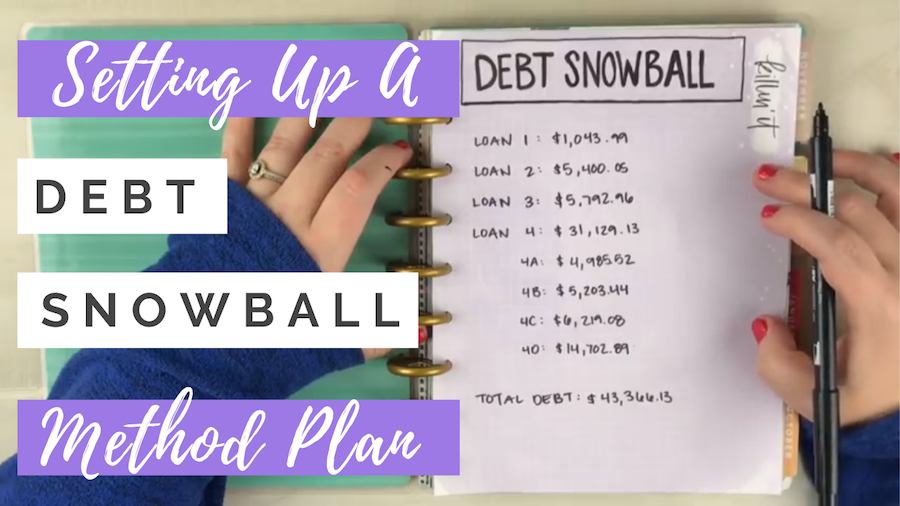

When we starting paying off debt together my husband and I set up our debt snowball as follows:

- Loan 1: $1,043.99

- Loan 2: $5,400.05

- Loan 3: $5,792.96

- Loan 4: $31,129.13

Total debt: $43,366.13

You can see how we worked through the debt snowball with our debt snowball playlist where we adding videos showing our progress working through the debt snowball.

The debt snowball method worked well for me when I paid off $22,000 in student loans and $5,000 in credit card debt in my early 20s so I knew that the method would work well for me again.

While the interest rates of our newer debt snowball meant the lowest interest rate debt would be paid last, I knew the method was effective.

If you want to see how long it will take you to pay off your debt using the debt snowball method, you can use a debt snowball calculator is a great way to see how quickly a debt snowball can get you out of debt.

Using the Debt Snowball Payoff Method

Using the debt snowball to pay off debt is very simple in practice and works well for many people.

The first step is to make sure you are covering the minimum monthly payments on all of your debts. You should not stop paying your debts unless you are unable to cover you basic living needs like rent or food.

After you’ve covered all the minimum payments on your debts, you work on attacking your debts in the order of the debt snowball list you’ve created. You will send all your extra money toward that first smallest debt.

Every single month you will put all your extra money budgeted for debt payoff toward your smallest debt. You do this even if you are paying more interest on a different one due to interest rate. Once you’ve paid off the smallest debt you then take that entire amount and send it to the next smallest debt.

Rinse and repeat by knocking off debts from your list and then sending all the freed up money toward the next debt in line.

Debt Snowball Example

In practice the debt snowball might look like this with your list of debts:

- a dental bill for $1,000 that you are paying interest-free

- one credit card bill for $5,000 (at 22.9% interest)

- one credit card at $1,500 (at 15.9%)

- a student loan at $26,000 (at 6%)

With the debt snowball you would pay off the debts in this order:

- dental bill for $1,000 (0% interest)

- credit card at $1,500 (15.9% interest)

- credit card bill for $5,000 (22.9% interest)

- student loan at $26,000 (6% interest)

Each time you paid off a debt you would roll the payments toward that loan into paying off the next faster.

With the debt snowball you may end up paying off interest-free loans before you tackle the bigger interest debts.

Options Besides The Debt Snowball

What if you hate knowing you are paying more in interest?

If the debt snowball method makes you crazy because of the interest rates, you may want to consider the debt avalanche method or a debt consolidation loan.

With the debt avalanche method you would pay off those debts in a different order:

- credit card bill for $5,000 (22.9% interest)

- credit card at $1,500 (15.9% interest)

- student loan at $26,000 (6% interest)

- dental bill for $1,000 (0% interest)

You start with the higher interest rates and save the lower rate debt for later. This saves you more money in the long run.

With debt consolidation you would roll your higher interest loans into one loan at a lower interest rate. This would help you pay less in interest so you could eliminate debt faster.

Read more: My debt free journey story!

Debt Snowball Tips

Once you’ve got your debt snowball set up you can set about the business of making the debt snowball even more effective.

Budget Your Money

First, make your budget and see how much extra money you have to put towards the debt each month above the minimum payments.

Using extra money from your budget is how you will eliminate the debt that you are tackling.

Not sure how to budget? Check out these useful posts and resources:

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

Find More Money

Next, find ways to free up even more money for your debt snowball.

You can do this one of two ways: increasing income or decreasing expenses.

You can decrease expenses by eliminating bills or living frugally. Cutting your budget and giving yourself less spending money each month frees up money for debt payments.

You can increase income by doing a side hustle or by increasing your income at your regular 9 to 5 job. Finding ways to earn more money can help speed up your debt payoff. I used my side hustle to pay off my debt in two years!

Here are a few ways to earn some extra money for debt payoff:

- Make Money With Canva (10 Ways)

- How to Make Money Selling Stickers On Etsy

- How To Make Money On YouTube

- Side Hustle Ideas For Moms

Your debt snowball will be most effective when you are able to find even more money to throw at the debt each month.

The more money you put toward your debts, the more you will progress in the snowball and the faster it will go.

Use Debt Snowflakes

My favorite way to increase the effectiveness of a debt snowball is to use debt snowflakes.

What is a debt snowflake?

It’s when you use little bits of money here and there to make a debt payment to increase the debt snowball.

The small daily savings and “found” money that you can add to the debt repayment in terms of debt snowflakes can truly add up and make a difference.

Need more help? Read this: 10 Tips To Pay Off Debt

A Debt Snowball Payoff Tracker designed with snowflakes to help you track the progress you are making paying off debt during your financial journey.

The debt payoff tracker includes two different debt snowball payoff coloring trackers.

This payoff tracker is inspired by the debt snowball method.

Is a debt snowball right for you?

When choosing your debt repayment method you have to select the right method for you. You’ll need to consider several factors including personality.

Using a debt snowball calculator will let you compare the different options and decide which method is the best for paying off your debts.

It can be tempting to go with the debt avalanche plan for paying off debt but you have to think about more than just the numbers.

Debt payoff is usually about more than just the numbers.

You know yourself and how you handle money and what motivates you.

The best debt payoff plan is the one that you will stick with.

A debt payoff plan does you know good if it is mathematically the best choice but you abandon it.

That’s why the less financially effective method of the debt snowball might be the best one for you – because it includes motivational wins that help you stick with it.

Why I Chose The Debt Snowball

For me, I like breaking down larger goals into smaller ones. Having more frequent milestones and payments is motivating to me. (It’s also why I combine the Weekly Transfer Method with the Debt Snowball.)

Breaking down large goals into smaller subgoals can help you stick with an overall plan. This is especially helpful if you think it will take years to pay off all your debt.

If you think the debt snowball method will motivate you to pay off debt, then that is the method you should choose.

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.