Are you a budgeting beginner? Trying to revamp your budget after time off? This budget categories list can help give your budget a refresh!

Sometimes it helps to see a list of expenses and budgeting categories to help find all the expenses you might have in a month.

The following is a long list of budgeting expense categories and even it is not comprehensive! Before you budget I highly recommend you sit down and try to write out every budget category you might use with this as a starting point.

Income

- Salary (paycheck)

- Side hustle

- Bonuses

- Tips earned

- Reimbursements

- Alimony (received)

- Child support (received)

- Gifts (received)

- Investment income

- Passive income

Housing

- Mortgage

- Rent

- Home Owners Association (HOA) fees

- Home improvements/upgrades

- Property taxes

- Home maintenance/repairs

- Home warranty

- Lawn care

- Home security system

Utilities

- Electricity

- Internet

- Cable

- Phone

- Heating

- Garbage

- Recycling

- Water

- Sewer

- Natural gas

Food

- Groceries

- Restaurants

- Fast food

- Coffee shops

- Alcohol

- School lunches

- Work lunches

- Events

- Costco membership

- Grocery delivery service

Transportation

- Car payment

- Gas

- Charging costs if electric

- Car maintenance (oil changes, tire rotation)

- Car repairs (when something breaks)

- Annual car fees (registration, inspection)

- Car tags

- Car wash fees

- Parking fees

- Car taxes

- Public transportation (subway, taxis)

- Uber/Lyft ride sharing cosots

- Tolls (EZ Pass)

- Roadside assistance (AAA)

Clothing

- Adult clothing

- Kids clothing

- Dry cleaning

- Alterations

Kids

- Daycare or Tuition

- Babysitters

- Extra-curricular activities

- Toys

- Kids sports gear

- Allowance

- Baby necessities (diapers, formula)

- Tuition

- School uniforms

- School supplies

- Child support

Personal Care

- Haircuts/barber

- Hair coloring

- Nail salon

- Eyebrows

- Massages/Spa

- Makeup

- Toiletries

Medical

- Doctor visits

- Dentist visits

- Hospital visits

- Prescriptions

- Over the counter medication

- Glasses, contacts, contact solution

- Vitamins/Supplements

Insurance

- Medical insurance

- Dental insurance

- Vision insurance

- Mortgage insurance

- Renters insurance

- Car insurance

- Life insurance

- Property insurance

- Disability insurance

- Long-term care insurance

- Identity theft insurance

- Pet insurance

Wellbeing

- Gym memberships

- Personal development

- Therapy

- Coaching

- Conferences

Household

- Cleaning supplies

- Laundry supplies

- Paper products

- Tools

- Furniture

- Appliances

- Home decor

- Pool supplies

Subscriptions

- Magazines

- Professional Society annual fees

- Netflix/Hulu

- Amazon Prime

- Music (Spotify, Pandora)

- Sports TV subscription (like ESPN)

- Software subscriptions

- Identity theft protection

Recreation

- Bars

- Movies

- Concerts

- Sporting Events

- Hobbies

- Hosting parties

- Books

- Family membership fees

- Pocket Money

Pets

- Veterinarian visits

- Pet food

- Toys, accessories, beds

- Pet clothes

- Pet medication (i.e. flea shots, heart worm medication)

Giving

- Tithes

- Offerings

- Charity donations

- Miscellaneous giving

- Tips

Gifts

- Holiday gifts

- Birthday gifts

- Wedding/wedding shower gifts

- Baby/baby shower gifts

- Service gifts

- Other occasions

Travel

- Vacation

- Trips to see family

- Trips for weddings,

- bachelor/bachelorette parties

- Souvenirs

- Baggage fees

- TSA Pre-check or Global Entry

Services

- Financial advisor

- Lawyer

- Tax professional

- House cleaner

- Yard care

Miscellaneous

- ATM fees

- ID renewal fees

- Postage

- Holiday spending

- Family pictures

Taxes

- Federal taxes

- State taxes

- City taxes

- Property taxes (could be under Housing)

Savings

- Emergency Fund savings

- College savings

- Retirement savings

- Car replacement savings

- Health Savings Account/Plan

- Long term savings goals

- Short term savings goals

- Investments

Debt Repayment

- Credit card debt

- Student loans

- Medical debt

- Personal loans

- Auto loan payments

- Extra mortgage payoff

- Alimony

How To Use The Budget Categories List

This list. of budgeting categories should be used as inspiration to get you started with your first budget.

First, look the list over and write down all the categories where you know you spend money or expect to spend soon. Not every category will apply to your budget.

Next, use the list of budget categories you’ve written down to plan out your monthly budget. Give each category an assigned spending amount.

Then, track your spending and assign each expense a budget category so it’s applied properly.

Finally, reconcile actual spending to your budgeted amount. What categories were under budget? Which were over budget? Where do you need to make some changes?

Evaluate what spending happened during the month that was outside of the categories you chose. Should you add a new budget category for this expense?

Budgeting Tips

Budgeting can be difficult to grasp at first but for many people it becomes second nature. It’s definitely a skill you can practice and improve over time.

We have a lot of different budgeting tips and tricks here that can help.

Learn more from these budgeting guides:

- How To Create Your First Budget

- Budgeting Tips For Beginners

- How To Set Up Sinking Funds | Sinking Funds 101

- 13 Sinking Fund Categories For Your Budget

- Top Sinking Funds Categories

- How To Grocery Shop On A Budget

We also have multiple printable guides to help you write out a budget. Writing out budgets can help you process the information in a different way that helps you better stay on track financially.

Practice your budgeting skills with these budget worksheets:

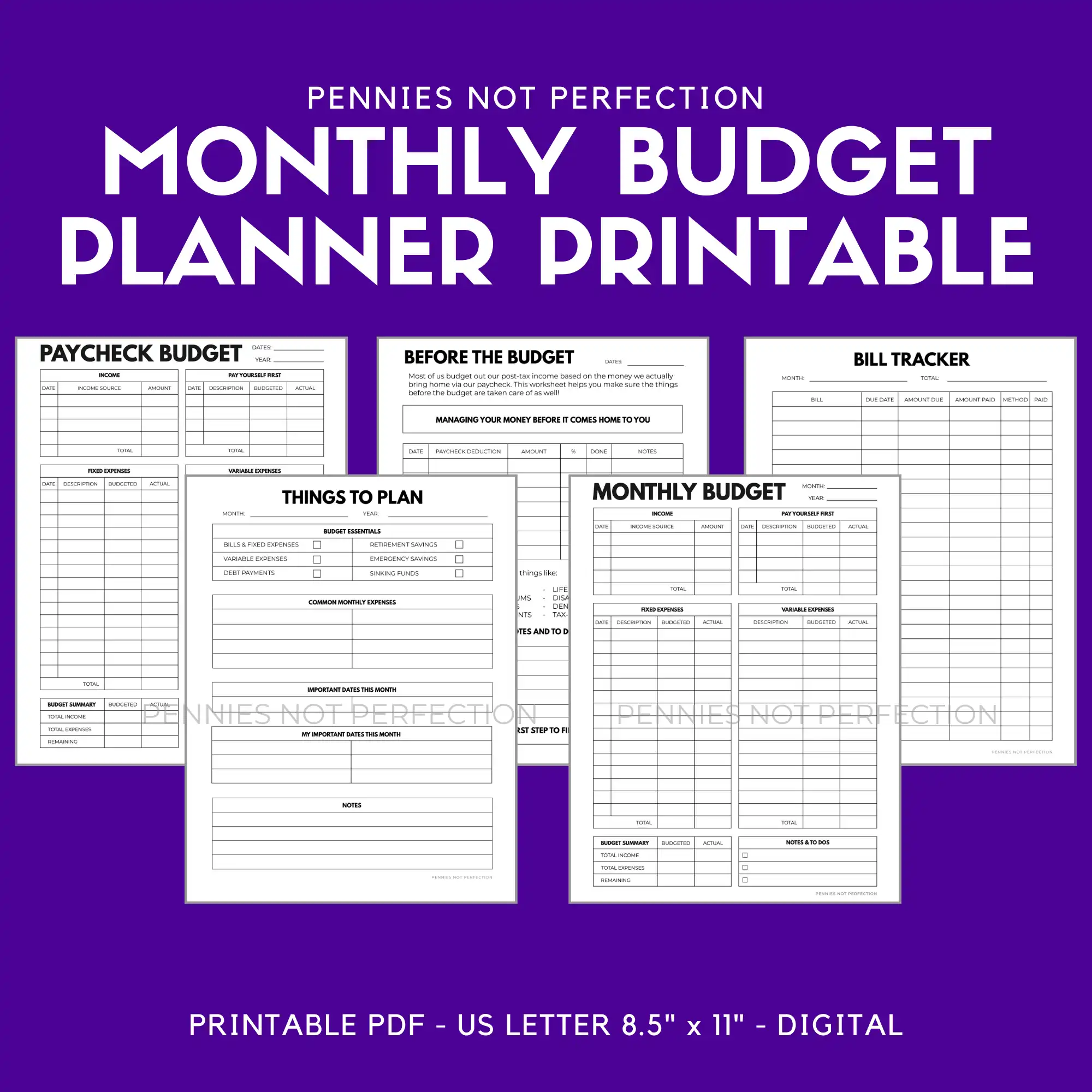

This monthly budget printable is a grouping of everything you need to plan and track your monthly budget. These monthly budget worksheets are designed to help you keep your budget on track by writing it down each month and tracking where your money goes.

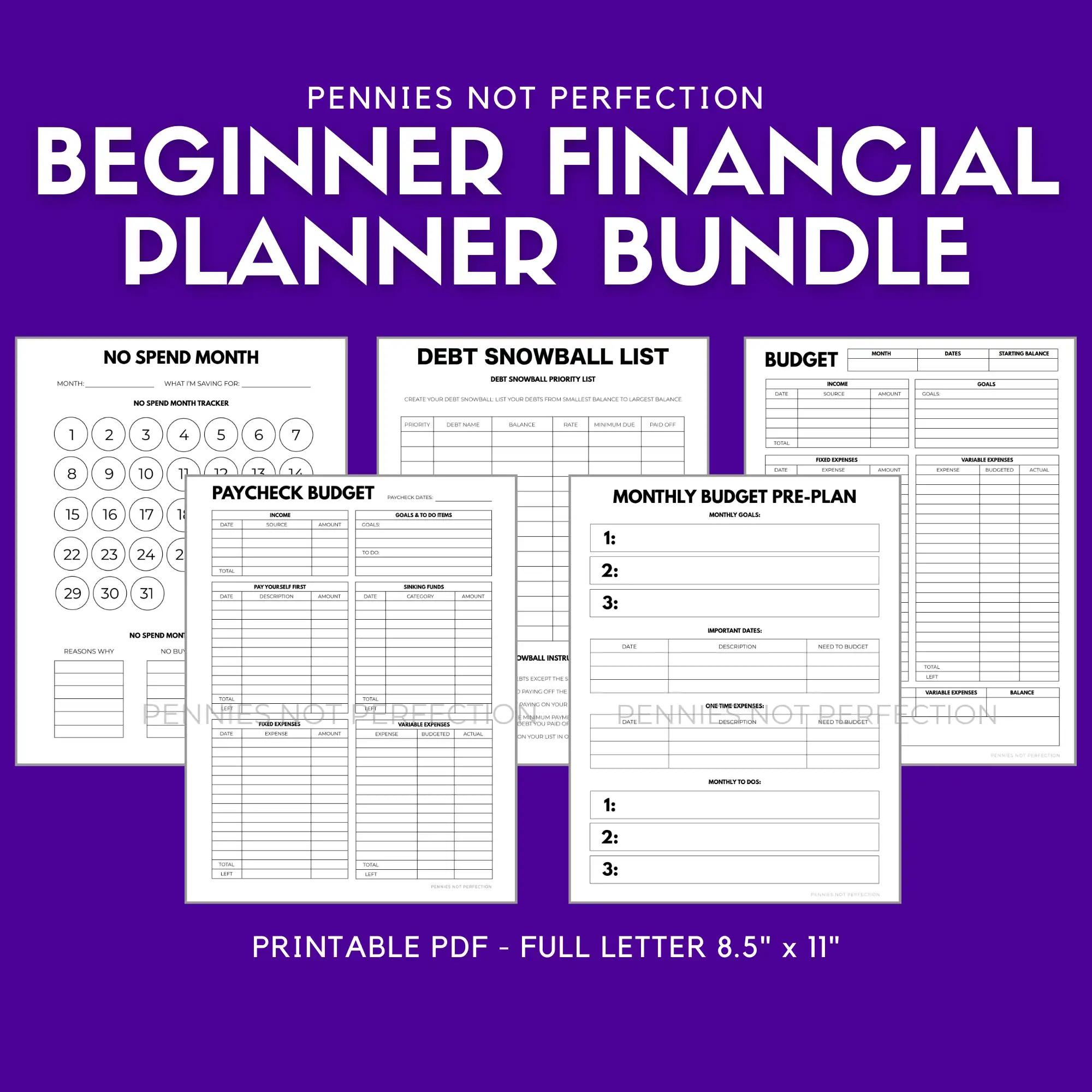

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

Budget Categories List Final Thoughts

Budgeting is HIGHLY personal so this list has many things that do not and will never apply to your lifestyle. Your budget is going to be specific to you and how you want and need to spend your money.

Some people love to break down their budget into as many categories as possible. Others like to keep it super simple with just some big overarching categories. It can be as complex or as simple as you want it.

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.