Do you want to pay off your mortgage faster? It’s possible! But it’s also NOT EASY.

In this video I share 7 strategies to help you pay off your mortgage faster.

Here’s some ways to pay off your mortgage faster:

- Understand your mortgage & how it works.

- Set up biweekly mortgage payments.

- Make extra payments toward principal.

- Make big lump sum payments toward principal.

- Refinance your mortgage if helpful.

- Rent out rooms (house hack to mortgage freedom).

- Downsize your house and mortgage.

- Bonus: Avoid risky schemes to skip the hard work!

Let’s look at each of these in depth so you can learn how to pay off your mortgage.

REAL Ways To Pay Off Your Mortgage Faster

Paying off your mortgage is a goal for many people for personal and financial reasons.

Maybe you want the peace of not having a mortgage payment. Maybe you need to pay off your home before you retire and end up with a lower fixed income.

Not everyone plans to pay off their mortgage, but for those that do these mortgage payoff tips will help you on the journey to complete debt freedom, house and all.

Understand Your Mortgage

Before making any decisions about paying off your mortgage faster, it is important to understand the basics of how mortgages work.

The key to paying off a mortgage is knowledge.

You need to understand how mortgages work and how the interest is calculated using an amortization schedule.

The amortization schedule is a breakdown of how much of your monthly payment goes towards interest and how much goes towards the principal. Knowing this information will help you make informed decisions about how to pay off your mortgage faster.

It will allow you to use real numbers and scenarios to understand how extra payments will affect your mortgage balance.

Setup Biweekly Payments

By making bi-weekly payments on your mortgage instead of monthly payments, you can pay off your mortgage faster.

If your bank allows you to make a half payment every other week instead of just monthly, that works out to 26 half payments or 13 whole payments a year.

This pays down your mortgage faster because you will be making one extra payment per year, which will go towards the principal and help reduce the amount you owe.

With a $350,000 loan at 4% interest over 30 years, you would pay off your mortgage four years early and save over $35,000 in interest just by making a bi-weekly payment instead of a monthly payment. And honestly?

It can be easier to budget for a half payment biweekly than one big monthly payment.

This is something we have personally done in our mortgage journey that has helped us cut years off our mortgage loan payments.

Make Extra Payments

One of the simplest ways to pay off your mortgage faster is to make extra payment toward your debt. Extra payments should go directly towards the principal you owe.

By doing this, you will reduce the amount you owe and in turn, the amount of interest you will pay over the life of the mortgage.

If you wanted to keep it simple, what you do is take one month’s mortgage payment and divide that amount by 12 and then add that amount to each of your 12 monthly mortgage payments. This makes you pay one extra payment in principal per year.

Make sure when you set up the extra payments they are going directly to pay down principal not just pre-paying your next payment. The benefit is gained by reducing the overall mortgage principal you owe.

Need to find ways to make extra money for your payments? Check out some side hustle ideas!

Make Big Lump Sum Payments

Whenever you get a lump sum you can use that to make a bigger payment to reduce your mortgage principal. This will pay it down faster and save a lot in interest.

What kind of situations allow normal people to make lump sum payments?

- Tax returns

- Yearly Bonuses

- Inheritances

- Insurance settlements

You can use these chunks of money to pay down your mortgage faster.

Budget To Find Money To Pay It Down

Creating a budget and sticking to it will free up extra money to put towards paying off your mortgage faster.

One of the most effective ways to pay off your mortgage faster is to create a budget and stick to it.

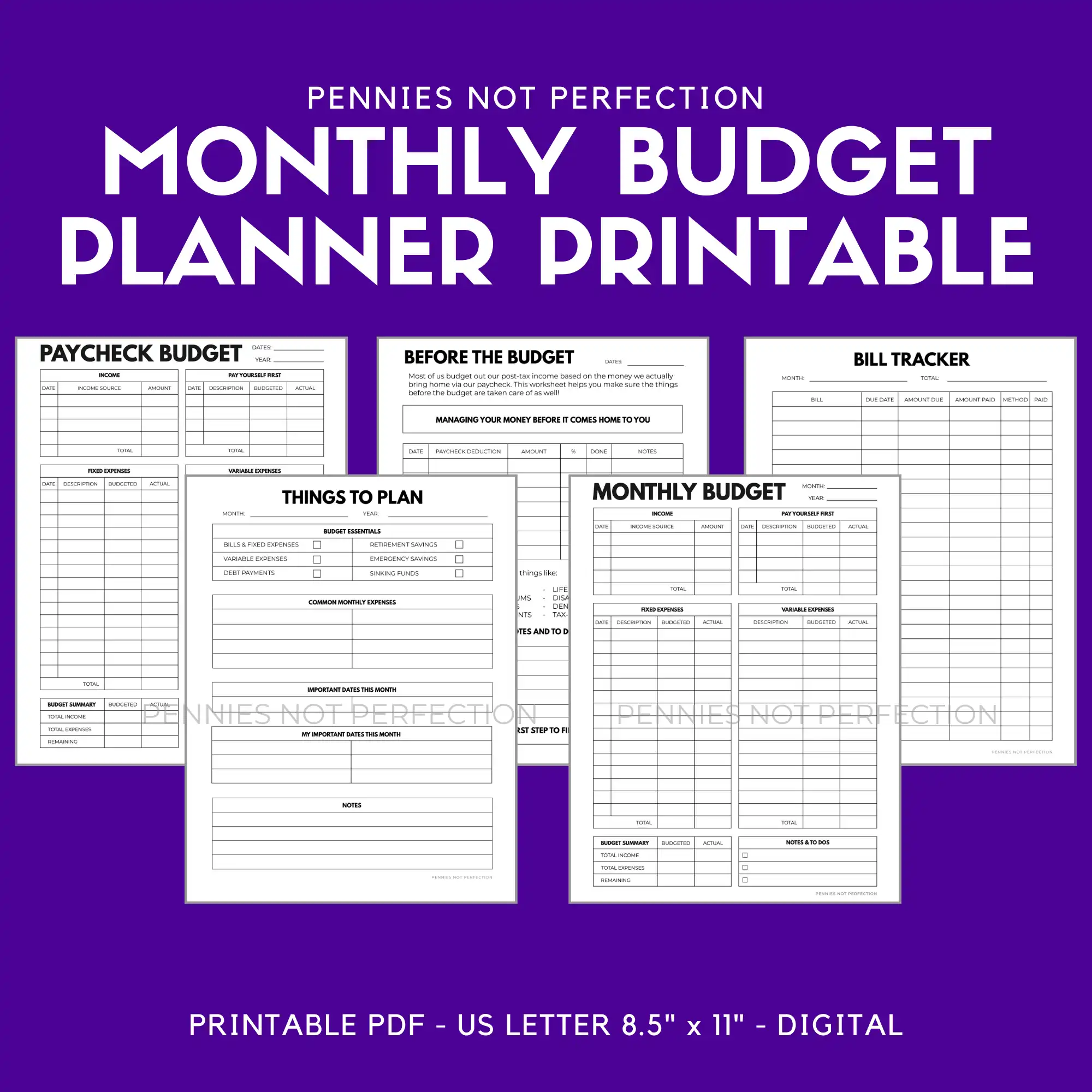

This monthly budget printable is a grouping of everything you need to plan and track your monthly budget. These monthly budget worksheets are designed to help you keep your budget on track by writing it down each month and tracking where your money goes.

Not sure how to budget your money effectively?

Learn about the different budgeting elements:

By budgeting your money and cutting back on unnecessary expenses, you can free up extra money to put towards paying off your mortgage.

Start small and try to grow the gap in your budget to put toward your mortgage payoff every month.

Refinance Your Mortgage

Refinancing your mortgage to a lower interest rate can help you pay off your mortgage faster.

By reducing your interest rate, you can lower your monthly payments and have more money to put towards the principal.

This works well when mortgage rates are low like they were in 2020. It’s not a strategy that will help you when interest rates are high, but keep it in mind for when times change.

This strategy worked well for us personally since we refinanced in 2020 to a very low interest rate. You can watch our home mortgage refinance experience in the video below.

Rent Out Rooms

Renting out a room or space in your home can generate extra income that can be put towards paying off your mortgage faster.

If you have space you can consider renting out a room in your home to generate extra income to use towards paying off your mortgage. This form of house hacking allows some people to live rent free AND pay off a mortgage fast.

This can include renting out a spare room on Airbnb or renting out your garage or storage space to a tenant. You can get creative with renting out your space if you have a small home.

Renting rooms to roommates can super charge your mortgage payoff.

Find Government Assistance

Need more help? Look into government programs that may offer assistance with paying off your mortgage.

There may be government programs available that offer assistance with paying off your mortgage.

Researching these programs and finding out if you qualify for any of them can help you pay off your mortgage faster.

Downsize Homes & Mortgages

A less popular mortgage payoff strategy is to downsize to a smaller home and pay off your mortgage faster.

Downsizing to a smaller home can help you pay off your mortgage faster because you will most likely have a smaller amount to pay off.

By selling your current home and buying a smaller one, you can reduce the amount of your mortgage and have more money to pay it off.

In some cases, you can even sell a larger home for a huge profit and then purchase a home entirely in cash skipping the mortgage process.

Avoid Risky Schemes

It is important to include this bonus tip: avoid anything risky.

Avoid things that use terms like velocity banking and be aware that many schemes like this work based off people misunderstanding how mortgages work.

Velocity banking is a term that is often used to describe a strategy for paying off a mortgage faster using a line of credit but it’s risky and flawed. With this method you use a line of credit to make a payment on your mortgage and then use your cash flow/income to pay down the linke of credit. It’s usually a HELOC.

On paper and in YouTube videos they can make this seem like a magical solution that frees up money. However, the reality is that you just divert cash flow to paying down credit and bring on all the risks of using this method.

Therefore, it is important to be cautious about using this term and be aware of its potential risks.

If something sounds too easy then it likely is a bad idea.

Paying Off Your Mortgage

If you want to pay off your mortgage then you will.

I personally know many mortgage free home owners and hope to one day join them when we pay off our first home and others.

Remember that for most of us paying off a mortgage early will be hard work and there are not many shortcuts. Accept that and get to work so you can live mortgage free!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.