Are you looking for frugal living tips that actually work? Want to save money without reusing ziploc bags? You’re in the right place.

You may want to live frugally to achieve a big financial goal like paying off debt or buying a house, or maybe you have to live frugally to survive.

Being frugal isn’t my natural state but I’ve learned a lot of easy ways to be more frugal in life thanks to the debt free community.

I’ve learned so much and continue to stock up tips to implement in my life to make us spend less money and live a better feel with a strong financial future! Living more frugally allows us to hit our financial goals faster which improves our lives overall. Being frugal is a great tool to have in your financial toolkit.

Here are the 25 frugal living tips I’ve learned that have helped save us money!

1. Plan meals around what you have.

Planning your meals around food you already have will help you save a lot of money in your food budget.

You can save money from your grocery budget by first checking your pantry and fridge to see what you already have on hand.

Make your weekly meal plan based on items you have for the base of your meals. This way you won’t be buying duplicates or items that don’t work with what you already have in stock.

Shopping your pantry before you shop the grocery store will also help you save a ton of money by reducing food waste. You’ll be less likely to waste money by throwing away unused food if you regularly use your pantry to create meal plans.

2. Learn to DIY things for free on YouTube.

Even if you don’t consider yourself handy you are likely to be able to DIY many things you would otherwise spend money on hiring someone to do.

You can learn how to fix almost anything thanks to YouTube and the content creators that share how-to videos. If you need to have something repaired, check to see if you can learn how to DIY the repair on YouTube.

You’ll save a lot of money by using this technique and you will learn some new skills as well. We’ve managed to do small car repairs, fix plumbing issue, and more thanks to YouTube diy videos.

3. Evaluate expenses based on hours worked.

Many people fail to practice frugality on large purchases because they often have such emotional weight attached to them.

When you are considering a large purchase, it helps to put it into perspective by dividing the price by your hourly wage. You’ll find out how many hours you have to work to pay for that item which will likely give you a better idea of whether the purchase is worth it or not. Do you really want to work all those hours to buy that item?

We often don’t think about how long we must work to pay for the items we purchase and this exercise can stop you from buying a number of items.

4. Consider consuming more frugal friendly content.

Have you considered how much the content you consume affects your spending habits?

If you are constantly watching hauls and commercials and shows that encourage spending then you will likely want to spend more. Continually watching or reading content that encourages spending will make you want to spend more money.

I found this true in my own life and had to limit the amount of YouTube haul videos I watched because I found myself wanting to buy items I didn’t really need.

Swap out more frugal friendly content and skip ads so you will be more likely to stick with your frugal living goals.

5. Use appliances singularly at off peak hours.

Sometimes going against the crowd is a great way to be frugal and save money. This is definitely true with your electric usage!

When you are trying to cut back on your utility bill you can do a number of things to reduce it like only using major appliances one at a time. You can also use these appliances – like the washing machine, dryer, dishwasher – during off peak hours when the rates for electricity are cheaper.

If you don’t know when your off peak hours are then you can check with your utilities provider to find out when you would get reduced rates.

6. Buy a smaller home.

Frugal people generally don’t live in mansions filled to the brim with stuff in every room.

Buying a smaller home can be a conscious decision to stay frugal. You will have less space to fill so you will naturally spend less money furnishing and won’t be tempted to overfill the space with items you don’t need.

Our first home was a smaller home and we chose it because we knew we didn’t (and probably never will) need a 4,000+ sq ft house.

Buying a smaller home saves you money in many ways from less furniture spending to fill it up to cheaper electricity bills keeping it cool.

7. Declutter your house so you don’t lose things.

Disorder and clutter leads to financial mistakes and disorganization.

Often living in cluttered spaces or letting items build up over time makes it hard to remember what you actually even own. Have you ever been unable to find an item you swear you already bought but couldn’t… only to find the item after you bought a replacement? That’s a frugality fail my friends.

Keeping things decluttered and minimal will allow you to find the things you need instead of accidentally buying duplicates because you can’t find what you need.

8. Sign up for birthday freebies and discounts.

Everyone loves getting free stuff on their birthday! I definitely love all the perks and freebies available on my birthday each year.

Even if you don’t get birthday gifts any more you can still get free things thanks to many companies that offer birthday freebies.

Even more companies offer birthday discounts, so sign up for the mailing lists of the companies and products you love the most to get these when your birthday rolls around each year.

9. Inflate your tires properly.

It might seem like a small thing, but keeping your tires properly inflated will save you a lot of money on gas because it improves your car’s gas usage.

You’ll get the best possible miles per gallon out of your car with properly inflated tires, so make sure they stay inflated and immediately air them up when the light comes on.

This is something that only takes a small amount of change to do.

You can also buy an air compressor tire inflator and do it at home. We bought one for under $40 and have kept our tires inflated for years with the DIY method.

10. Learn to sew and care for your clothing.

Basic clothing care doesn’t take a lot of skill so learn but can ultimately save you a lot of money by taking care of your items.

Learning how to do basic clothing care like sewing on buttons can save you time and money.

This will help extend the life of your clothing and allow you to get more use out of each piece. You won’t have to replace clothing as often if you are able to do basic maintenance.

11. Close off rooms you don’t use regularly.

If you’ve bought a house much bigger than you need you can close off rooms you don’t use.

This will save you money on furniture and home decor and it will also keep your utility bill down.

We did this when we first bought our home and it save us a ton of money that first year!

All you do is leave rooms empty and unfurnished and then shut the doors and vents! You don’t have to heat or cool the space you aren’t using regularly.

12. Buy reusable food storage containers.

Instead of using disposable food container products or even plastic tupperware that eventually gets thrown away, buy durable reusable food storage containers.

This will likely cost more upfront but you will ultimately same more money in the long run. Investing in quality items upfront is often a more frugal choice long term.

We purchased a set of glass food containers a while back and have been using them successfully since then. We haven’t had to buy new containers which has saved money!

13. Order light ice or no ice in drinks.

If you eat out and order drinks, ask for light ice or no ice at all. You’ll get more of the actual drink you want and it will still be cold enough to enjoy.

Again, this might seem like a super small frugal tip, but that’s the beauty of all these tips. There is no item too small to save on!

This has actually worked well for me with my Starbucks habit. I know I’m going to buy coffee every week but using multiple small frugal living tips allows me to stretch my coffee budget further!

14. Use cashback apps on top of sales and coupons.

Coupons are the bedrock of frugal living but cashback apps are the icing on the cask and my personal favorite way to shop frugally.

The great thing about cashback apps is that you can stack them on top of store sales and regular coupons for additional savings. You can use as many money savings apps on one purchase as possible to make the products you buy as cheap as possible.

I like to use Ibotta along with Fetch Rewards every time I shop since you can double up certain apps.

Some of my favorite cash back apps even give you a bonus when you sign up:

15. Use reusable dryer balls instead of dryer sheets.

Instead of disposable dryer sheets you can buy dryer balls that are reusable.

Both make your clothes fluffy soft but the dryer balls can be used over and over again. This saves you money in the long run by making a one time purchase versus buying dryer sheets over and over again.

This worked out perfectly for us since the dryer balls I bought worked well and my husband hated dryer sheets in his laundry.

We’ve actually tried two different types of dryer balls: spiky dryer balls and wool dryer balls. Both worked great!

16. Save delivery packaging for future shipping.

When you receive packages from places like Amazon, save the packaging! Find a safe place to store this packaging material for future shipping so you won’t have to buy it again.

You can use the boxes or the padded envelopes for future shipments. This will save you from buying packing supplies at the post office. You could also use it as boxes to wrap for birthday gifts or frugal Christmas presents!

17. Stock up on household items on sale.

You’ve likely have a list of household items that you know you’ll eventually need to use.

These things like furnace filters or laundry detergent are staples in running your household. Anything in your household that you need to use over and over again is a great candidate for buying in bulk when it goes on sale.

When something you use often is on sale at a great price you can stock up and save yourself a lot of money for the future.

18. Stretch laundry detergent with baking soda.

This one was completely new to me entirely, but you can combine baking soda with your laundry detergent to stretch your detergent a bit further!

It also makes your whites whiter and your brights brighter so you’ll save money and have nicer looking clothes! Baking soda is incredibly inexpensive and it will save you a lot of money.

19. Buy used clothes on Ebay to update your wardrobe.

Buying clothing second hand is an obvious frugal choice.

There are many ways to buy used clothes: thrift stores, estate sales, from friends, Facebook groups, Mercari, eBay.

Buying clothes via Ebay in a lot can help you change out your whole wardrobe on a dime. I’ve bought used clothes often before but I love this tip for switching out your whole wardrobe by buying a “lot” on Ebay in a certain size!

I’m actually planning to use my own winter wardrobe this way. It’s a cheaper way to shake things up and get lots of new clothes in a frugal way.

Bonus tip: resell your clothes on Ebay too as a side hustle so your clothing costs are eliminated entirely!

20. Use grocery story bags for dog walks.

Let’s be honest: dog poop is gross and buying bags to pick it up is expensive.

You can buy special bags with fragrances to pick up dog poop… or you can just reuse plastic grocery bags you get from the grocery store.

Let’s be honest, you can also skip both of these all together if you really love the earth by using a reusable poop bag you buy once and wash over and over.

21. Dress for the weather to save on heat/air.

Your electric bill is one area where frugal living tips can save you money every single month.

How do you do it? Dress for the weather to use less heat or air.

If it’s cold outside, wear layers and keep the heat down. If it’s hot outside, wear less clothing and keep your temperature higher.

Adjusting your clothing to the temperature rather than adjusting the temperature in your home will save you a lot of money. No matter the weather, dress for it and keep your house slightly off the “normal” temperature to save money on your utility bill.

22. Eat less meat overall.

Eating less meat each week can be very good for your body, your budget, and the earth. It’s a win, win, win.

Buying less meat will lower your grocery bill so even a couple vegetarian plant-based meals each week will help you reduce your spending.

23. Cut your own hair or go to a cosmetology school.

Cutting your own hair can save a ton of money if you need it regularly. My husband learned how to cut his hair on YouTube and has been giving himself haircuts for years. He got so good he also gives his family haircuts!

If you aren’t sure of your skills you can go to a cosmetology school where students will do the work and charge much less than a normal salon. I’ve done it and the savings is substantial over a high end salon.

24. Shop based on unit price.

Grocery stores design their stores to make you spend more money overall. They use marketing and psychology to make you less frugal while shopping.

This means you need to keep an eagle eye, and possibly a calculator, when you are shopping.

Shop for everything based on the unit price instead of the item price. Often the smaller item with the lower price is a better deal than the large bulk buy based on the unit price.

This is just one of the grocery frugal living tips you can learn and use from my friend Kelly’s

25. Use YouTube for workouts.

You can use YouTube for almost anything, including getting fit!

There are many different workouts on YouTube and there are channels dedicated to giving you free and ever-changing workouts, from yoga to HIIT to pilates.

I personally love doing yoga videos from YouTube. My therapist actually recommended Yoga by Adrienne and I’ve loved doing her videos for free at home!

A gym membership might not fit in your budget, but using YouTube workouts is one of the frugal living tips you can easily implement.

Bonus: Have frugal friends around you!

You tend to become like the people closest to you so surround yourself with budget conscious friends who want to support your frugality!

Even if you aren’t planning to be frugal forever, it can truly help to put more frugal people in your life for a period of paying off debt for instance.

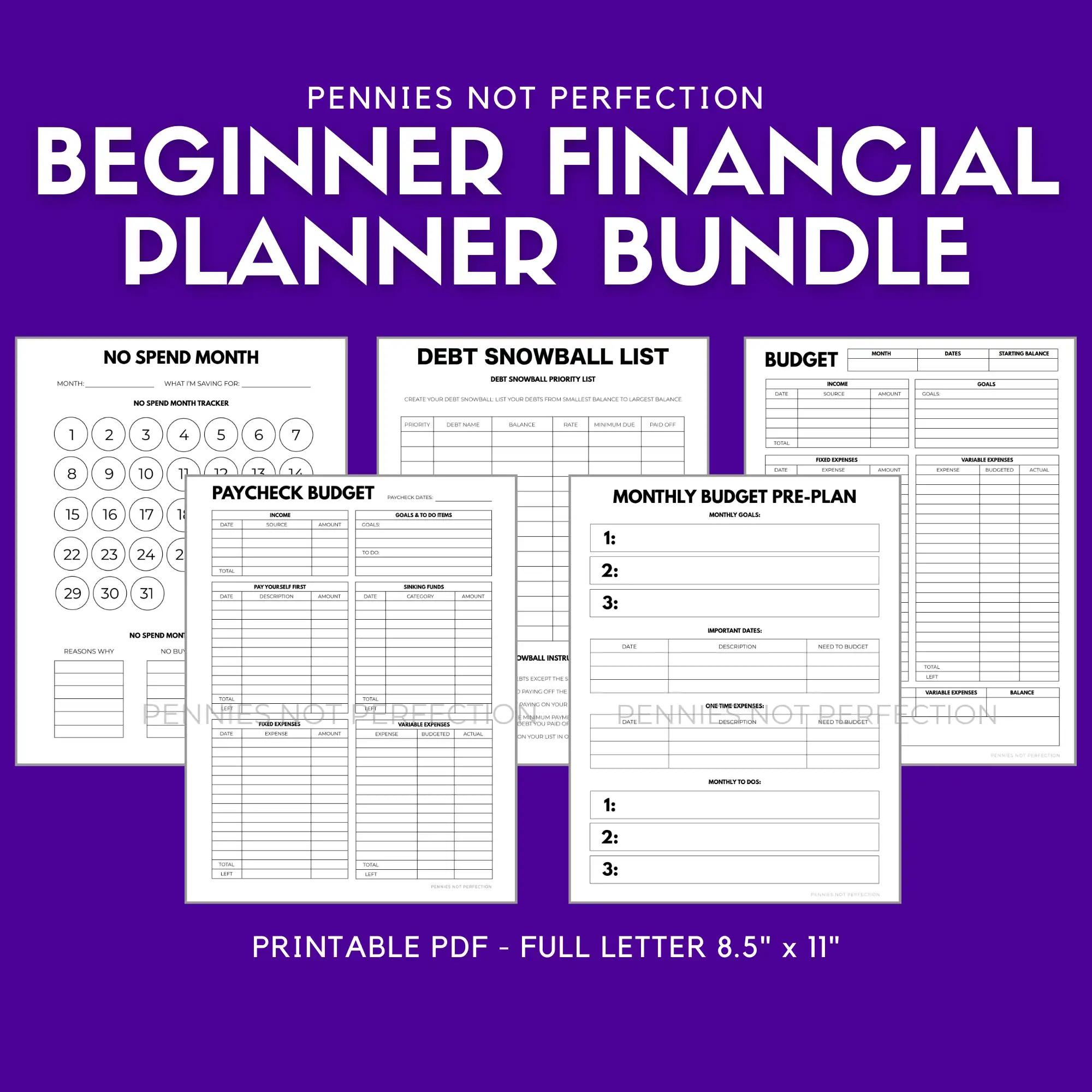

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

More Frugal Living Tips

I’m happy to be your frugal friend! I love thinking about ways to be more frugal in my own life and share posts about frugality like these:

- Frugal Beauty Tips

- Frugal Living Tips For Christmas

- Reasons To Get Out Of Debt

- Frugal Christmas Gift Ideas

Enjoy more frugal living, friends!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.