When I first started budgeting, I followed the Dave Ramsey approach. Years later I still think the Dave Ramsey budget percentages and debt payoff advice is worth using.

If you’re new to budgeting and feel overwhelmed, consider starting with a plan like Dave Ramsey’s.

There are many personal finance and budgeting opinions out there but at the very least you know Dave Ramsey’s budget advice is proven to work.

Using a guide like Dave Ramsey’s recommended percentages for each budget category allows you to find a starting place and then you can perfect your budget from there.

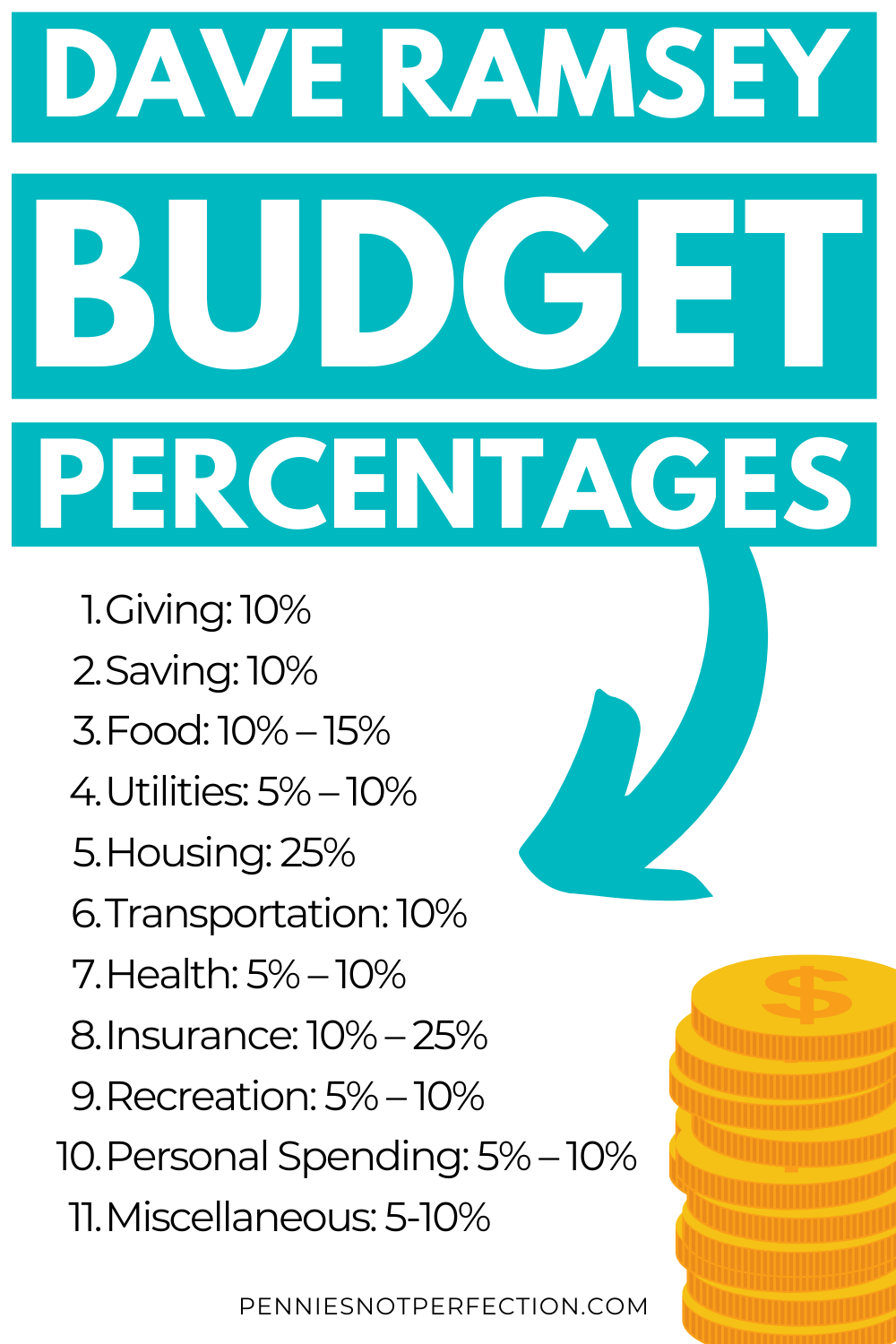

Dave Ramsey Budget Percentages Quick Guide

Let’s quickly look at what he suggest for budgeting to help people manage their budgets.

Here are the categories and percentages Dave Ramsey recommends:

- Giving (10%)

- Saving (10%)

- Food (10% – 15%)

- Utilities (5% – 10%)

- Housing (25%)

- Transportation (10%)

- Health (5% – 10%)

- Insurance (10% – 25%)

- Recreation (5% – 10%)

- Personal Spending (5% – 10%)

- Miscellaneous (5-10%)

This quick guide to the budget percentages for each category helps new budgeters answer common questions like:

- “How much should I spend on food?”

- “What amount should I be saving monthly?”

- “How can I fit debt repayment into my budget?”

- “What is too much for a rent payment?”

Having a guide for budgeting out your salary will help you feel less overwhelmed and more in control when answering these common budget questions.

Related budgeting posts:

- What Is The Purpose Of A Budget?

- Budget Categories List

- Budgeting Tips For Beginners

- Monthly Budget Planner

Who Is Dave Ramsey?

Dave Ramsey, or Uncle Dave as his superfans call him, is a personal finance guru that grew a small radio show into a financial empire. He shares common sense financial advice that helps people get out of debt and budget better.

But Dave wasn’t always good with money. He actually filed bankruptcy in 1988. Dave started building a real estate empire at age 18 just to have it all crash down around him years later. He had to start over again and rebuild his foundation financially.

Because of Dave Ramsey’s experience going broke he sticks with conservative and common sense money advice. He knows what it’s like to recover from a financial setback and his show’s ability to give both practical advice and hope has made him incredibly popular.

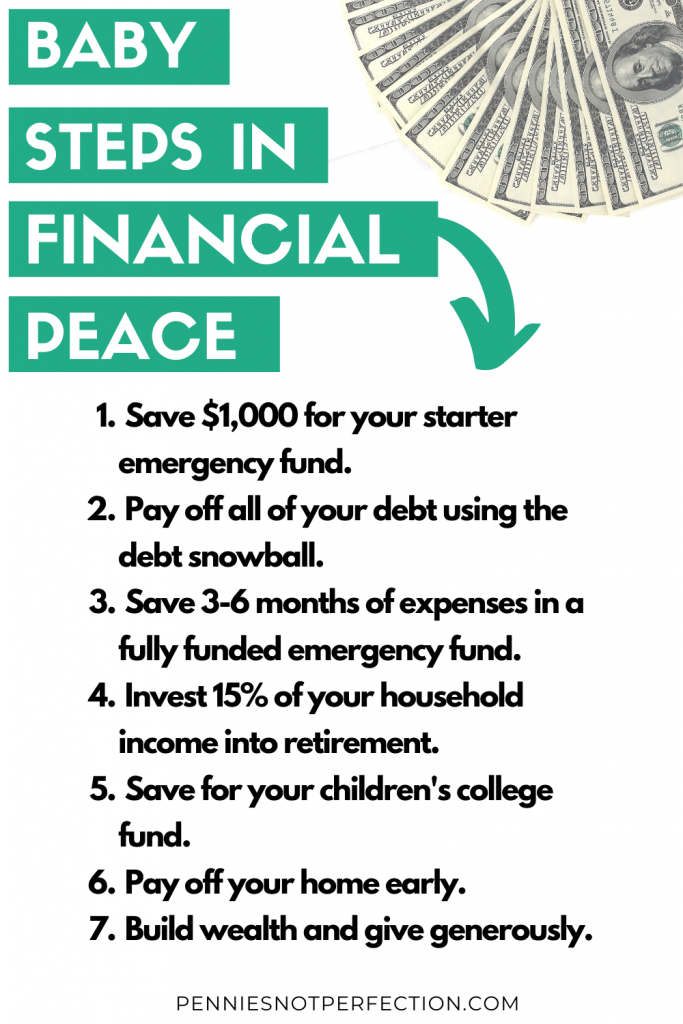

The Dave Ramsey budget percentages, debt payoff plans, and general financial tips have helped hundreds of thousands of people improve their lives. His 7 Baby Steps for financial peace have turned many lives around positively.

Dave Ramsey Budget Percentages Explained

Let’s look at all of Dave Ramsey’s budget percentages in depth and evaluate how you can apply this method to your budget.

Following this system of budget percentages is easy but it will take you a while to figure out the adjustments right for YOUR budget. No two budgets will be the same and while percentages can help you get started you will need to tailor it to fit your lifestyle.

As a reminder, here are the categories and percentages Dave Ramsey recommends:

- Giving (10%)

- Saving (10%)

- Food (10% – 15%)

- Utilities (5% – 10%)

- Housing (25%)

- Transportation (10%)

- Health (5% – 10%)

- Insurance (10% – 25%)

- Recreation (5% – 10%)

- Personal Spending (5% – 10%)

- Miscellaneous (5-10%)

You’ll notice that some of these are a range and that’s because Dave knows you’ll need to adjust depending on your circumstances.

Let’s look at each category more in depth.

Giving (10%)

Dave Ramsey is an evangelical Christian and part of his lifestyle includes tithing 10% to his local church. This is the foundation of his giving category but you don’t have to be religious to include giving in your budget.

In fact, if you are in a position to give back to others then you should do so. Giving creates gratitude, contentment, and appreciation of money in your life.

There are many ways you can give money:

- give to your favorite local charity

- hand out money via tips and donations

- help out family or friends with specific needs

- donate to mutual aid funds

- give to your local church

However you decide to include giving in your budget you will find it provides much in return. Dave Ramsey’s budget percentage for giving is 10% but you can always start smaller and increase the number as you go.

Saving (10%)

Saving money is incredibly important and Dave Ramsey recommends you save 10% of your income each month.

Savings can be allocated for a number of things:

- saving for a 3-6 month emergency fund

- money for long term goals

- money for shorter term goals

- savings for future expenses like cars and college

Saving money is a key element of personal finance and one that Dave Ramsey agrees with. However, he recommends paying off your debt before saving large amounts of money.

To stay in line with full Dave Ramsey financial plan you would save a starter emergency fund of $1,000 and then pay off all your debts with a debt snowball, and then start saving money for other things.

Food (10% – 15%)

Food is expensive and costs more every year. And if you spend for convenience? It’s even more costly to your budget.

For food spending the Dave Ramsey monthly budget percentage is 10-15% of your income. So if you make $5,000 per month then your food budget should be $500-$750 per month. This includes groceries and food in restaurants too.

Depending on the size of your family and your habits this amount can seem low. Unfortunately many of us spend too much in the food category and this is why the percentage seems so low. To help with this you can do things like meal planning, buying in bulk, or starting a garden.

Here are a few ideas to help you stick with the lower grocery budget:

Utilities (5% – 10%)

Your utilities should only take up 5-10% of your budget according to Dave Ramsey.

This category includes:

- gas bill

- electricity bill

- heating bill

- water bill

- garbage bill

In some places all of these bills are separate and in some cities they are all combined. I only have one bill for all of these items for example.

Some people like to expand this utilities category to also include things like their internet and phone bills. Adding these bills while keeping it to the 5% to 10% goal can help you reduce costs as needed.

Housing 25%

Dave Ramsey gets a lot of pushback but he suggests you should only use 25% of your income for housing.

This percentage applies whether you buy a home or are renting. If you make $5,000 per month then you should only spend max $1,250 per month on housing.

In most markets $1,250 won’t get you much. This is one of the reasons why people argue with this Dave Ramsey budget percentage: it’s just too low in many places. But Dave suggests that going higher than 25% on housing will leave you struggling financially in other areas.

Dave Ramsey has a lot of opinions about home ownership. He wants you to buy a home, put 20% down, keep the payment to 25% of your income, and pay off the home early.

Transportation (10%)

Transportation varies widely depending on where you live but Dave says you should not spend more than 10% on it per month.

Your transportation budget can include:

- car payment

- gas for your car

- public transportation fees

- uber or lift rides

- toll passes

There are lots of things that can fall under the category of transportation. This will really depend on where you live and how you get around. Maybe you have a car or maybe you don’t. Maybe you have access to public transport or maybe you don’t. Your budget will be very specific to your needs here.

Health (5% – 10%)

Many people say your health is your wealth. If you aren’t healthy then you will need money to help take care of yourself.

The health budget category can cover things like doctor’s visits and dental care. This doesn’t have to be spent each month and instead could be done as a sinking fund for when you need to use it.

This category doesn’t include health insurance since that is in a different category. This just includes what you will be paying as you go. If you have kids plan to be at the higher percentage number!

Insurance (10% – 25%)

Unfortunately in the US especially, insurance is a necessary evil. It’s boring, expensive, and often feels like a scam but it’s still important.

No one wants to spend money on insurance but in many cases you need it. Here are some of the insurance types you might need:

Dave Ramsey suggest you spend between 10-25% of your income monthly on these various insurances.

It might be tempting to skip paying for insurance but it’s important to have when you need it.

Recreation (5% – 10%)

Recreation or lifestyle spending should fit within 5-10% of your budget according the the Dave Ramsey system.

You can do anything, from weekly classes to expensive gym memberships to attending concerts, as long as it fits within this budget percentage.

You probably don’t want to always check with your budget or run a Dave Ramsey budget percentages calculator just to see if you can spend time with friends. I get it. That sounds terrible! But staying with in the 5-10% range for recreational fun spending will make your life easier in other areas.

Basically, have fun but do it responsibly!

Personal Spending (5% – 10%)

Personal spending is a necessary part of any budget. My husband and I struggled to budget properly until we allowed ourselves personal spending money we could use on anything.

Personal spending is money set aside to spend on anything you want.

Maybe you like to buy random stuff on Amazon or seasonal home decor. Maybe you like to get facials or have your nails done weekly. Whatever it is, just make sure it fits within the personal spending budget category.

Miscellaneous (5%)

Having a miscellaneous category can cover expenses that aren’t expected during your budget time frame. This can be things that pop up that you want to cash flow instead of dipping into your emergency fund.

The miscellaneous spending category can be tailored to better fit your individual life. The longer you’re budgeting the more comfortable you’ll be knowing what expenses can be put here versus planned for in other categories.

What About Debt Payments?

This suggested budget from Dave Ramsey assumes you are already debt free.

If you’re not debt free? Then this budget should be slashed as much as possible until you are. The Dave Ramsey style of debt payoff is very intense and suggest you should cut out all fun spending until you are debt free.

If you are in debt you could cut out (or cut down) the spending in categories like recreation, personal spending, and miscellaneous to spend that money on debt payments instead.

Paying back debt is a huge component of Dave Ramsey’s famous baby steps. If you are currently in debt you’ll work hard to eliminate it on his plan.

Need some helpful ideas for paying off your debt? I’ve got you covered here:

- Tips For Paying Off Student Loans

- How Student Loan Refinancing Works

- 10 Best Reasons To Get Out Of Debt

Dave Ramsey Budgeting In Real Life

Even Dave Ramsey tells you that these budget percentages are just a guideline.

You have to sit down and make a new budget every month to give your money a place to go. You will adjust certain budget categories up and down depending on the situation that month.

Real life situations can sometimes cause your budget to not match these percentages.

For example: rent. Are the Dave Ramsey percentages realistic when it comes to rent or mortgage payments? Not always. Depending on the area where you live it might be impossible to stay under 25% of your income on housing.

In those situations you just have to accept that it’s not realistic and adjust to fit your life the best you can.

Why Use Budget Percentages?

Budgeting by percentages of your income makes things easy for many people. It’s a quick way to give yourself guidelines for spending and saving.

Budget percentages allow you to allocate that percentage of your income to a specific purpose.

It gives every dollar a purpose. It also scales with income so if you start making more money you are able to adjust your spending easily without going crazy.

Other Budget Percentage Plans: 50/30/20 Budgeting

My other favorite way to budget your money with percentages is to do 50/30/20 budgeting.

The 50/30/20 budget divides your income into three categories:

- 50% of income on needs and essential expenses

- 30% on wants

- 20% on savings, debt payoff, and investments

It is an easy budgeting rule that helps you manage your after tax income in a way that covers all you need. You’re spending money on things you need, taking care of your future, and still having fun.

Senator Elizabeth Warren outlines this budgeting method in her book All Your Worth: The Ultimate Lifetime Money Plan. It’s a more simplified plan than the similar to dave ramsey income percentages breakdown, but both aim to have you saving and spending responsibly.

The 50/30/20 budget rule is actually one of the best and easiest ways to implement personal finance basics into your life.

What Else Does Dave Ramsey Recommend?

We’ve covered the budget percentages Dave Ramsey suggests, but what else does he recommend for budgeting? If you’ve watched his show for years like I have then you know he is a fan of the following.

Cash Envelope System

Dave Ramsey suggests cash spending. The cash only system forces many people to confront overspending and impulse purchases that wreck budgets. Dave recommends using cash and never using credit cards.

Dave’s daughter Rachel even has a cash envelope system wallet you can purchase. you can use actual envelopes of get a cute cash envelope binder with detailed envelopes.

With the cash envelope system you put the amount you’ve budgeted for a category in an envelope. When you spend that amount and an envelope is empty then you can’t spend any more.

Physically using cash forces you to pay attention to your spending and stick to your budget percentages. It also makes it harder to spend.

Sinking Funds

Dave Ramsey loves sinking funds and putting away money until you can pay for something.

Sinking funds are usually savings accounts that you set up where you put money aside each paycheck to save up for a specific purpose.

You can save up money for things like yearly expenses or large car maintenance. It’s a handy budgeting tool that helps you avoid using credit cards or falling into debt when big expenses occur.

If you’re new to sinking funds, check out these articles:

- Sinking Funds For Beginners

- Sinking Fund Category Ideas

- How To Set Up Sinking Funds To Hit Savings Goals

Zero-Based Budgeting

Another thing Dave Ramsey recommends is zero based budgeting. He even created the app Every Dollar to help people create zero based budgets.

Zero based budgeting is where you give every dollar a job.

You allocate every dollar to expenses, savings, debt, or whatever you need that month. Your income minus your planned expenses should total out to zero at the end. This method of budgeting combines the Dave Ramsey budget percentages with a practical application of totaling out to zero with your budget plan.

If you’re new to budgeting this can be a really help way to set up your first budgets. Giving every dollar a job allows you to follow a close plan and not allow any money to disappear.

Need a little help setting up your budget? Check out my budget planner for an easy to use system for writing out your budget by hand (very helpful when you are new).

This monthly budget printable is a grouping of everything you need to plan and track your monthly budget. These monthly budget worksheets are designed to help you keep your budget on track by writing it down each month and tracking where your money goes.

Getting Started

We’re at the end and you’ve learned about the Dave Ramsey budget percentages along with some practical applications.

Are you ready to get started? Can you implement budget percentages into your life?

Remember that you don’t have to be perfect. Your budget is going to be a mess, especially in the beginning. You don’t have to be perfect, you just have to get started!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.