Christmas spending derails many budgets but with you can have a debt free and stress free Christmas this year. Christmas shopping on a budget is possible with some planning and organization.

I love Christmas and I love gift giving. It’s my love language. But it also created massive bills and post-holiday anxiety in the past.

I wasn’t full able to enjoy the season because I fell into the trap of consumerism and debt. After letting my Christmas shopping ruin the actual holiday I learn how to spend in a way that lets me enjoy the season.

Having a written plan and a budget crucial to enjoy the Christmas season without stress or debt.

Want to enjoy Christmas shopping on a budget? Keep reading!

How To Plan For Christmas Shopping

Today I’m going to share our process for having a debt free Christmas while still enjoying shopping and traditions.

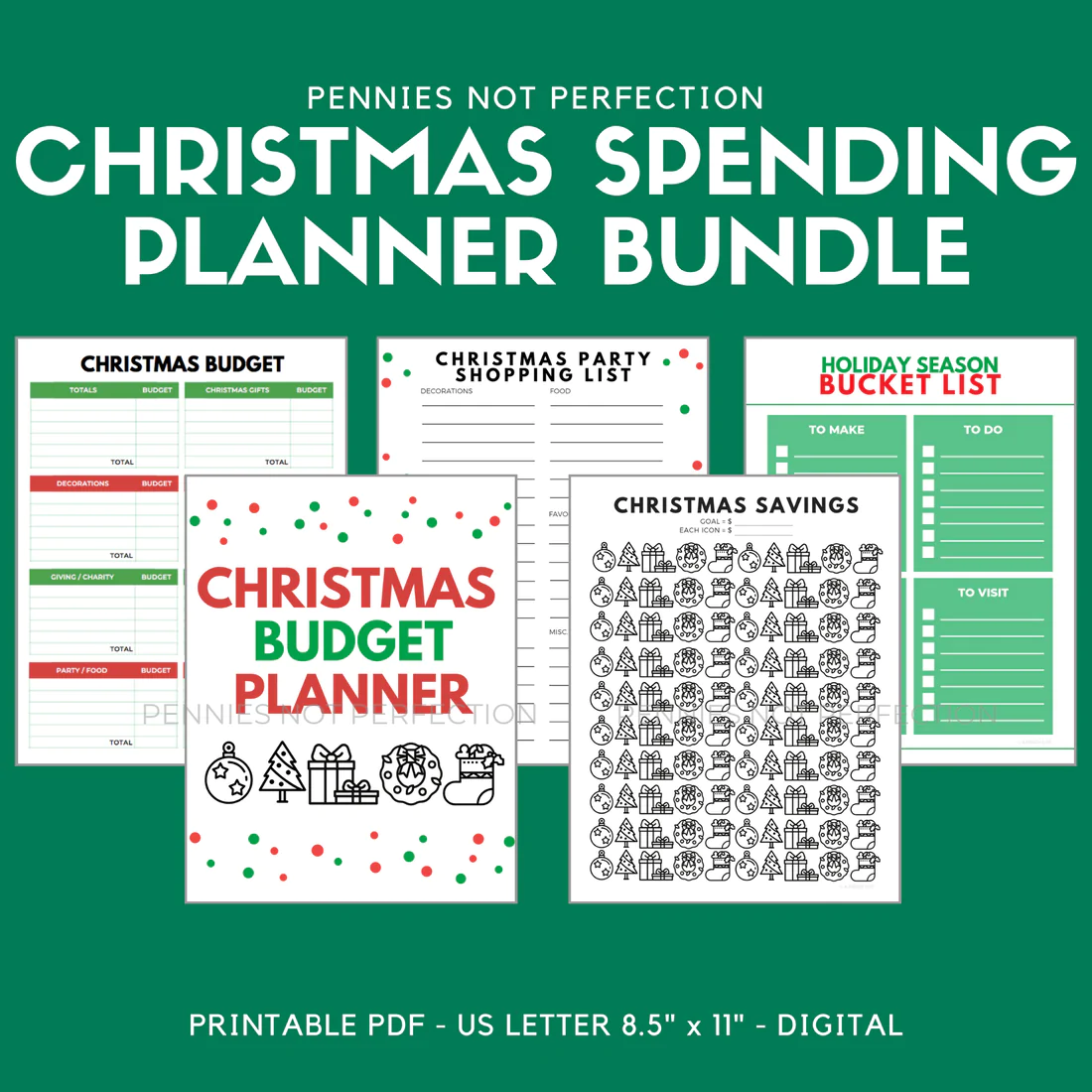

In this video I used the printables I created based on my Christmas planning process to get through the holiday season debt free. You can purchase these or just create your own written system by hand.

The important thing is to get organized and write everything down so you don’t forget things.

Start Planning Early

The earlier you start planning for Christmas the more opportunities you have to cover all your bases and skip stressful last minute issues.

We start our planning for Christmas around July or August so that we are able to save up money for our Christmas shopping. This gives us plenty of time to build a generous Christmas budget.

Things you can plan ahead for your Christmas shopping:

- who you need to buy gifts for

- what special events you will be attending

- how much you want to spend per person

- what stores you like to shop at and when they have sales

- frugal gift ideas people will like

Pulling together as much information as you can upfront will allow you to take advantage of things like sales.

Set A Christmas Shopping Budget

Big key to having a successful debt free Christmas is creating a holiday budget.

Several months before Christmas you should think of an amount you’ll need to accomplish all the fun activities and gift purchases. Another way to do this is set a spending limit for each gift and write out a list of all the people you have to buy for and work from there.

Count out how many paychecks you have left til Christmas and set a goal amount of how much you will need to save per paycheck until Christmas.

Not sure how to budget? Check out how to create your first budget.

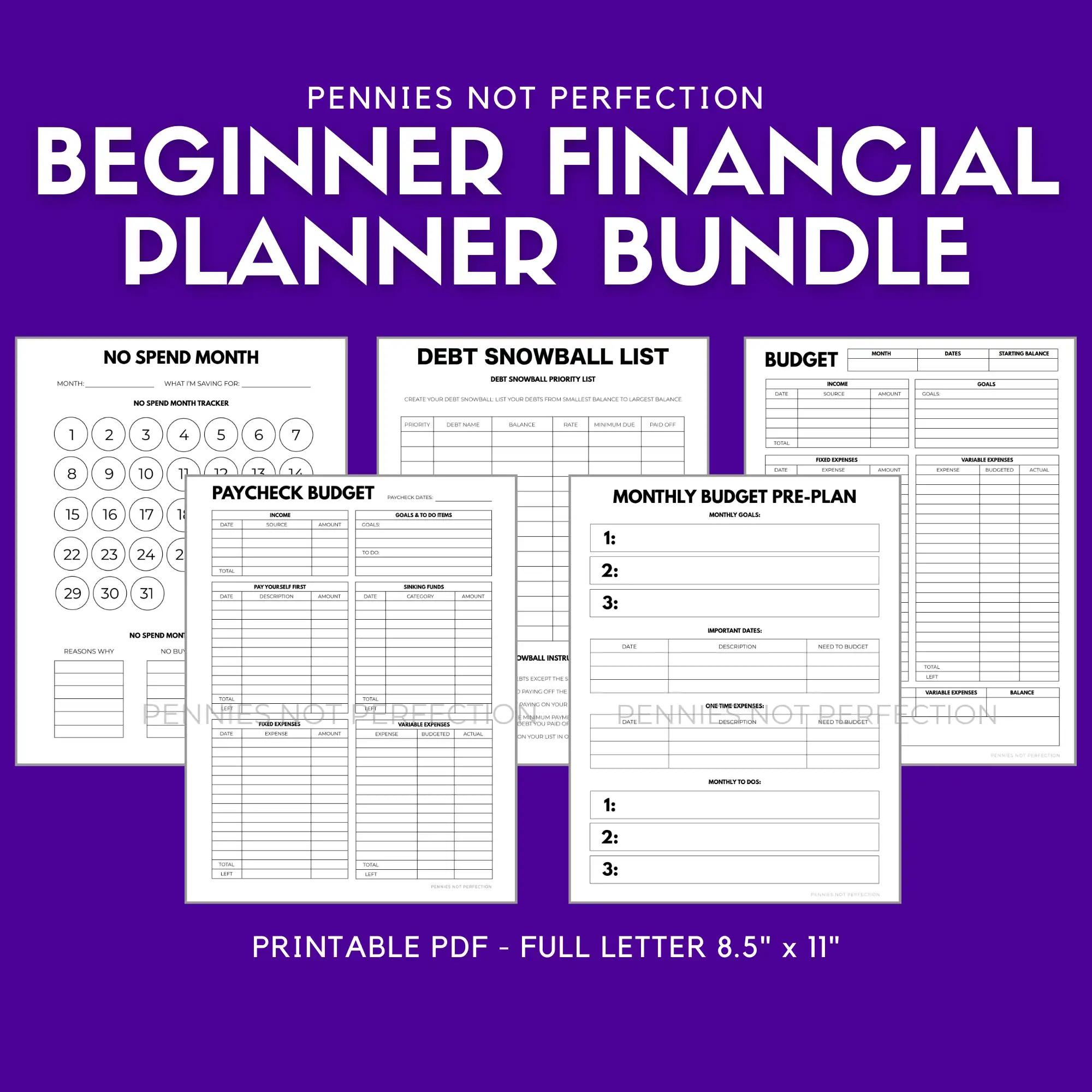

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

Start Saving Money Early

Making Christmas into a sinking fund category and saving early makes a huge difference. I start saving earlier and earlier each year and each time I move it up it makes it easier.

If you start saving in January or even the week after Christmas then you have much more time and can contribute smaller amounts than if you start in October. This year we are planning to start our savings in August after our beach trip is over.

The sooner you start saving the easier it is to take advantage of other tips like buying special gifts on sale throughout the year, because you already have the money available.

Open a savings account just for the holidays. Open a high yield savings account and you can get a bonus to use for the holidays to start your savings account. Then you can fund Christmas throughout the year each time you get paid or make extra money.

Get Organized

Being unorganized and waiting until the last minute is how many people overspend with Christmas shopping.

To stay true to your budget you’ll want to get organized. Having lists and ideas all written out and ready to check off makes things a lot easier.

A Christmas Planner bundle to help you plan for a stress free, debt free Christmas!

There are 15 pages to help you plan and execute a debt free, stress free Christmas season.

This Christmas planning bundle I made is based off all my old lists in my past planners.

When thinking about planning ahead for Christmas I went back and looked at all the things I’ve created in my planner the last few years that we’ve had debt free Christmases.

It helps to write everything down so you can plan out a budget for everything.

Track What You’ve Already Bought

One year I received the wrong gift from a friend because she did so much Christmas shopping she forgot who she bought things for after a while. She just handed out gifts and hoped for the best.

Instead of wasting the money you’ve allocated to your Christmas shopping budget, you should track what you’ve already spent and who you spent it on.

If you buy a gift, write down what you bought and who you bought it for in your Christmas planner.

Keeping a running list of the gifts you’ve bought and the person they belong to even if it’s just in the notes section on your phone. This way you won’t over buy gifts or buy things with no recipient.

Cut Your Christmas Budget

There are several ways to cut your gift budget in half.

- Do a gift exchange with family where you draw names and only buy a gift for one person.

- Look for great gifts throughout the year in clearance sections to score big savings.

- Remember that not everyone needs or wants a gift so cut our gift giving where you can.

- Use ebates if you shop online so you’ll get money back for things you are buying anyway.

- Get creative and make gifts for people on your list. There are tons of easy things to make like homemade soaps, bath bombs, etc.

- If you have a big group of people, make something in bulk that you can then split up. You can make a huge batch of cookies and deliver it in a cute Dollar Tree bin for example.

Christmas Is About More Than Gifts

When you are writing out your holiday budget remember that the season is more than just Christmas gifts.

Remember that what really matters is spending time with the people that you love.

The ultimate goal is to get through the holidays debt free, skip the stress and spend your time with your loved ones.

Want more ways to save on Christmas? Check out this post on 33 Money Saving Tips For A Frugal Christmas!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.