I value being debt free and have paid off a lot of debt over the years as I’ve improved my financial situation. My experience paying off debt was grueling which is why I love to share tips to pay off debt.

Making debt payoff easier and less complicated is one of the goals with this blog.

I believe there are many reasons to get out of debt and also believe that everyone can do it.

Can You Ever Be Debt Free?

Unfortunately, many people in the United States believe they will never be out of debt.

A few years ago I read that at least 18% of people expected to be in debt forever. They literally expected to die while in debt. Others didn’t expect to reach debt freedom until their 60s or 70s. Some people even choose to carry debt and never pay it off because debt doesn’t bother them and they can ignore it.

Some people are so deeply in debt they have given up the dream of being debt free. When you are so deep in debt you can’t see a way out then you simply accept being in debt forever.

However, as part of the online personal finance community I know that you can be debt free.

I’ve seen people pay off thousands of debt. Tens of thousands. Even hundreds of thousands of dollars worth of debt. No matter what amount of debt you owe, it’s possible to eliminate it.

Let’s look at some tips to pay off debt so you can make a plan and pay off your debt.

Tips To Pay Off Debt

These tips for paying off debt can help you get a handle on your debt and eliminate it forever.

- Change your mindset and be more positive about debt repayment

- Create a debt repayment plan

- Track your spending so you know what you’re spending

- Create a budget and stick to it

- Stop increasing debt balances

- Negotiate lower interest rates on your debt

- Send larger payments each month to high interest debt

- Make weekly payments on your debt

- Find ways to earn extra income to make extra debt payments

- Put savings from lowering spending into extra debt payments

Now let’s look at each one in more depth.

Change Your Debt Mindset

Your mindset is the key to your success with debt payoff.

If you think you will never pay off your debt then you will be right.

If you think you will pay off your debt and be debt free then you will be right.

Whichever thought you choose is what will create your reality. When you think you can do something you are more likely to achieve it. You’ll be able to overcome obstacles and make moves toward your goal.

Changing your mindset is truly the first step in actually paying off debt. You have to start telling yourself that you will pay off the debt – matter how much you owe.

Create A Debt Repayment Plan

Creating a debt repayment plan is the next step in paying off your debt.

You can set up a debt snowball plan or another similar debt repayment plan.

The most common debt repayment plans include:

- debt snowball

- debt avalanche

- income based repayment

- graduated repayment

The debt snowball and debt avalanche plans are both accelerated debt repayment plans that can help you eliminate debt quickly. Both require discipline and can save you a lot of money in interest on your debt.

Choosing which debt repayment plan you want to use is critical to your success but remember that it can also be fluid. You can change later!

Track Your Spending

Tracking your spending is critical for budgeting and succeeding with money.

If you don’t know where your money is going then you can’t use it to pay down debt.

By tracking and analyzing your spending habits you are able to make a budget that will actually work. Tracking your spending will allow you to follow and succeed with the budget you make.

When you want to achieve a big goal like paying off your debt then you need to find a way to track every dollar you spend.

There are several ways to track your spending:

- passively track with an app like Mint or Personal Capital

- actively track by entering expenses into a spreadsheet

- write down all spending on a spending tracker printable

Chart your path to financial freedom by tracking net worth, spending, & investments in one easy to use FREE dashboard.

The best way to track your spending is the one that fits your needs and style. Different methods may or may not motivate you. The method that will work best is the one that you will stick to doing because it is effective for how your brain works.

Some people love to handwrite a log of expenses because it forces their brain to acknowledge the spending. Others could never do that amount of work and prefer passive tracking with charts and analytics.

Try a few different methods of tracking your spending until you find what works for you.

Create A Budget

Creating a budget you actually use throughout a pay period is very helpful when paying off debt.

Budgeting allows you to give all of your money a goal and it frees up money to do things like pay down debt.

There are many different ways to budget. There is no one “correct” way to create an implement a budget.

The best budgeting method is the one you actually use.

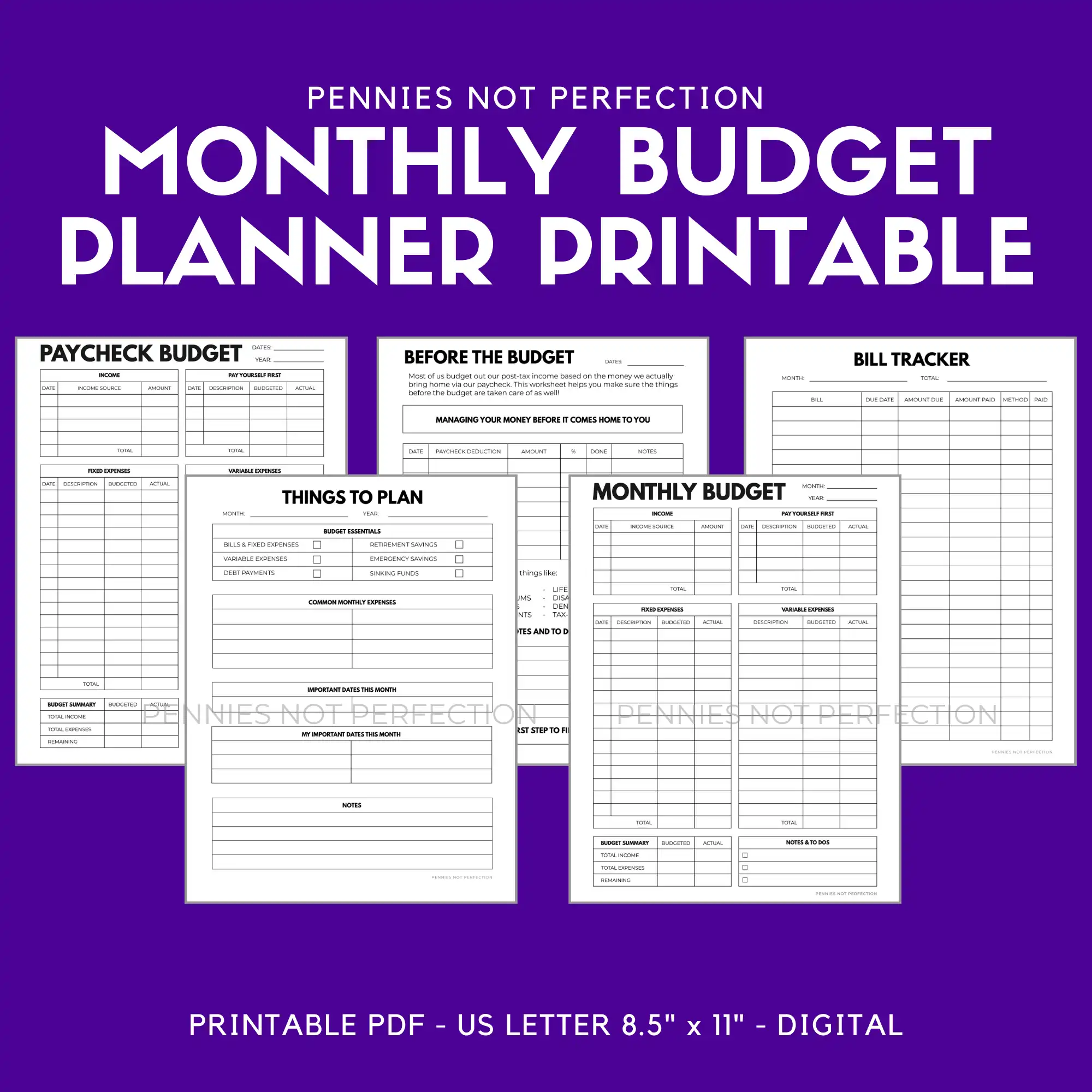

This monthly budget printable is a grouping of everything you need to plan and track your monthly budget. These monthly budget worksheets are designed to help you keep your budget on track by writing it down each month and tracking where your money goes.

Here are a few ways you could budget:

- using an app like Personal Capital

- writing out your budget with a budget printable

- using a budgeting spreadsheet

- using the anti budget method

- budgeting with separate bank accounts

If you’ve never budgeted before it might take a few tries to find the right method for your life. Even if you’ve budgeted for a while it’s important to remember that life situations change and you might need to adjust how you budget and track spending too!

Here are a few helpful resources for budgeting to get you started:

- How To Create Your First Budget

- Budgeting Tips For Beginners

- Budget Categories List

- Financial Bundle For Budgeting

Stop Adding More Debt

Before you eliminate your debt you need to stop adding more debt.

If you are still creating more debt then it doesn’t make sense to try paying it off. First you need to stop adding more and more debt to the pile. This is especially true for high interest debt like credit cards.

When you begin to pay off debt it is important to not work against yourself.

If you are trying to pay off student loans at a low interest rate then you definitely should not be adding more debt at a higher interest rate.

The people who ultimately pay off debt commit to not adding more debt to their lives. Living a debt free life begins with not adding any more new debt.

Negotiate Lower Interest Rates

When you are paying off debt you will want to get every advantage possible to help you pay it off. One of the best things you can do in this regard is to negotiate lower interest rates on your debt.

Some debt types allow you to lower the interest rate through negotiation.

With credit card debt you can sometimes call and ask for a slightly lower interest rate if you’ve been a good customer without late payments. Even dropping a couple points lower will save you money as you work to pay off debt.

With other debt types you can get a lower interest rate through refinancing your debt.

This is common with larger loans like mortgages or student loans. Once you have better credit you are usually able to refinance for a lower interest rate.

Any time you are able to pay less interest you will save more money and speed up your debt payoff.

Make Large Debt Payments

The fastest way to pay off debt successfully is to make large debt payments.

Any time you drop a large amount of money toward the balance of your debt you will make big progress.

When I personally paid off debt I built a YouTube side hustle and then paid my entire YouTube income toward my debt. This allowed me to pay off the debt a lot faster when I was able to put thousands per month toward the balance.

You can make large payments with bonuses, inheritances, side hustle paychecks, or tax returns.

Any time you get a large amount of money outside of what you need to live you can use that money to pay down your debt faster. Using these large lump sums will help you get out of debt much faster.

Make Weekly Payments

I used weekly payments to help pay off my debt faster. This is one of the most underrated tips to pay off debt or handle using credit cards responsibly.

I called this process Transfer Tuesday and it was a great way to stay accountable toward my debt payoff goals.

Making payments toward debt every single week makes the process feel more achievable since you aren’t forced to save up huge amounts for payments. It’s a great strategy for anyone who tends to spend their account down.

Depending on the type of debt you are attacking this could also save you money on the interest you will pay.

Weekly payments might not be for everyone, but if you try this strategy feel free to check in with me on YouTube every Tuesdays when I share what financial goal we are working toward with weekly transfers!

Create More Income To Use

The unfortunate truth for many people is that in order to pay off debt they will need to make more money.

This was true in my situation. To be able to pay off my debt I had to create more income. I decided to that through making content online and working overtime at my day job for over a year.

Earning more money is one of the key strategies to paying off debt successfully.

It might be hard to find time to earn extra money for debt payoff. Luckily this doesn’t have to be done forever. Once you’ve paid off your debt you can cut back on hours worked or drop extra side hustles.

Learn everything you need to know to create and sell printables online as a side hustle. Includes lessons, templates, and 24/7 support.

Not sure where to start on increasing your income?

One of my passions in life is teaching people how to earn money online. I’ve shared a ton of free information and tutorials here that can help you develop your own side hustle!

Check out some of these side hustle ideas and tutorials:

- Things To Sell On Etsy For Extra Money

- Make Money With Canva (10 Ways)

- Start A Reselling Side Hustle

- How to Make Money Selling Stickers On Etsy

Spend Less Money To Pay Off Debt

Spending less money is another way to pay off your debt faster.

Let’s be honest, this is not the most fun method of paying down debt!

Making sacrifices to your lifestyle in order to pay off debt might not be fun but it does work. The less money you spend the more you have to pay down your debt.

Here are some ways you can cut back spending in order to pay down debt:

- Cutting back spending on areas you don’t care as much about.

- Find ways to spend less money at restaurants or stop going out for a time.

- Cut coupons, shop for deals and buy food on sale.

- Decide to temporarily do a no spend challenge.

- Live with roommates to save money or house hack your mortgage.

Even just doing 1 or 2 of these can help you speed up the process of paying debt. Then when you are debt free you’ll be able to spend even more on living the life you love!

My Debt Payoff Journey

In 2018 I set up a debt snowball to pay off the remaining debt in my life: leftover parent plus student loans I had been ignoring and one student loan for my husband.

When we starting paying off this debt together my husband and I set up our debt snowball as follows:

- Husband’s Loan 1: $1,043.99

- My Student Loan 2: $5,400.05

- My Student Loan 3: $5,792.96

- (Multiple loans) Loan 4: $31,129.13

Total debt: $43,366.13

You can see how we worked through the debt snowball with our debt snowball playlist where I added videos showing our progress working through the debt snowball.

After one year of the debt snowball, I had made some progress and paid off several of the smaller loans.

We made a lot of progress paying off debt in 2019.

In the next year of paying off debt I kept changing the end date goal for my debt payoff.

I did this because I also did saved up an emergency fund, bought a car in cash, and maxed out my Roth IRA.

However, even with those other financial goals I worked on I was still able to finish paying off my debt on the very last day of 2021.

As a result, it took me just over 2 years to pay off the $43,000 debt snowball that I wrote out when I started.

My Previous Debt Payoff Experience

The debt snowball method worked well for me both in this experience and when I paid off $22,000 in student loans and $5,000 in credit card debt in my early 20s.

In 2010 I paid off $5,000 in credit card debt. In 2013 I finished paying off $22,000 in student loan debt that was in my own name.

That first expecience was a harder debt payoff experience in many ways because I spent most of those year not earning much money. I spent those years living very frugally so that I could pay off the debt quickly.

Tips To Pay Off Debt

If you are in debt, you can get pay it off! Whether it’s super fast or takes a couple years the process is worth it.

Here are a few tips to pay off debt recapped:

- Change your mindset and be more positive about debt repayment

- Track your spending so you know what you’re spending

- Create a budget and stick to it

- Stop using credit cards and increasing balances

- Negotiate lower interest rates on your debt

- Send larger payments each month to high interest debt

- Find ways to earn extra income to make extra debt payments

- Send savings from things like low gas prices as extra debt payments

- Invest in personal finance education and a debt payment plan

I hope these tips to pay off debt help you create your own debt free life! Following these tips and working hard to pay off your debt will yield a lot of positive results in your life.

Don’t just accept the idea that you have to be in debt forever. Work to make yourself debt free!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.