Financial troubles can be a difficult and stressful experience. Want to understand the reasons why you’re broke and how to fix them? You’re in the right place.

In this post, we’ll explore common reasons why people are broke and offer practical solutions to help you get back on track.

Spending More Than You Make

The cardinal sin of personal finance is spending more than you make.

Living beyond your means is one of the most common reasons people find themselves broke.

If you spend more money than you earn every month you are going to be going into debt. This debt can snowball and create an even bigger financial problem for you.

Spending more money than you make might not make you feel broke at first but it definitely will once the consequences catch up to you.

To combat this issue you need to know what you are earning, where your money is going, and how you can save money on expenses.

Need ways to save money? Check out these helpful posts:

- 9 Ways We SAVE Money With Rising Costs

- Best Cash Back Apps To Save Money

- Things To Stop Buying to Save Money

High Interest Debt

Want to feel broke? Carry a credit card balance and pay interest on that balance.

High interest debt like credit cards can spiral out of control quickly because of high interest rates. If you don’t pay your balance off each month then you’ll be paying 20% or more on that money.

This often leaves people on an endless wheel of struggling to use and pay off credit cards.

To avoid the dangers of high interest debt, you should plan to pay off debt as quickly as possible.

Some ways to get out of high interest debt include:

- paying larger payments as often as possible

- transferring balances to a lower interest rate or zero rate card

- negotiating the rate and fees down with the creditor

One you’ve paid off high interest credit card debt you’ll feel like you have a lot more money every month.

You just have to stay diligent about never getting into the same situation again.

Using credit cards is great but make sure you use them wisely. Otherwise you will end up broke.

Not sure how to pay off debts and get free from credit cards?

Big Expenses Take Too Much of Your Income

One common issue among people who are broke?

They spend too much of their income on big expenses like rent and cars.

Big expenses, such as homes and transportation, can quickly drain your finances and leave you broke.

Obviously you will feel broke when you spend 50% or more of your monthly income on rent. This is a much tighter financial situation than someone who spends just 25% of their income on housing.

Changing this financial issue can be difficult but it will lead to the most dramatic improvement in your finances.

Maybe you have to take on roommates to reduce your housing expense. Or maybe you start using public transportation instead of your own car.

Whatever you have to do to reduce these big monthly commitments will go a long way to freeing up your income.

Inflation Rises but Your Income Doesn’t

Sometimes you feel broke because the economy is leaving you behind.

Inflation can erode the value of your money over time, leaving you with less purchasing power. During periods of high inflation of consumer goods you will feel broke if your income does not also rise at an equal rate.

When your income doesn’t keep pace with inflation, you can find yourself struggling to make ends meet.

To counter this unfortunate reality you can look for ways to increase your income.

You might increase income by:

- asking for a raise at work

- working overtime hours and shifts

- getting a second job

- starting a side hustle

- learning how to make money online

Here are a few guides on ways to earn extra income:

- Make Money With Canva (10 Ways)

- Side Hustle Ideas For Moms

- How I Make Money Online

- 200+ Digital Product Ideas For Passive Income

Not Delaying Gratification

Delayed gratification is one of the pillars of personal finance.

If you don’t practice delayed gratification with your spending then you’ll constantly feel broke. You’ll wonder where all your money went and why you aren’t building wealth.

Learning to control your impulse spending can help you live a more rich life.

By learning to control your spending and wait for things you really want or need, you can avoid overspending and increasing debt loads.

Here are a few resources for curbing impulse spending:

- How To Stop Impulse Buying (13 Ways To STOP)

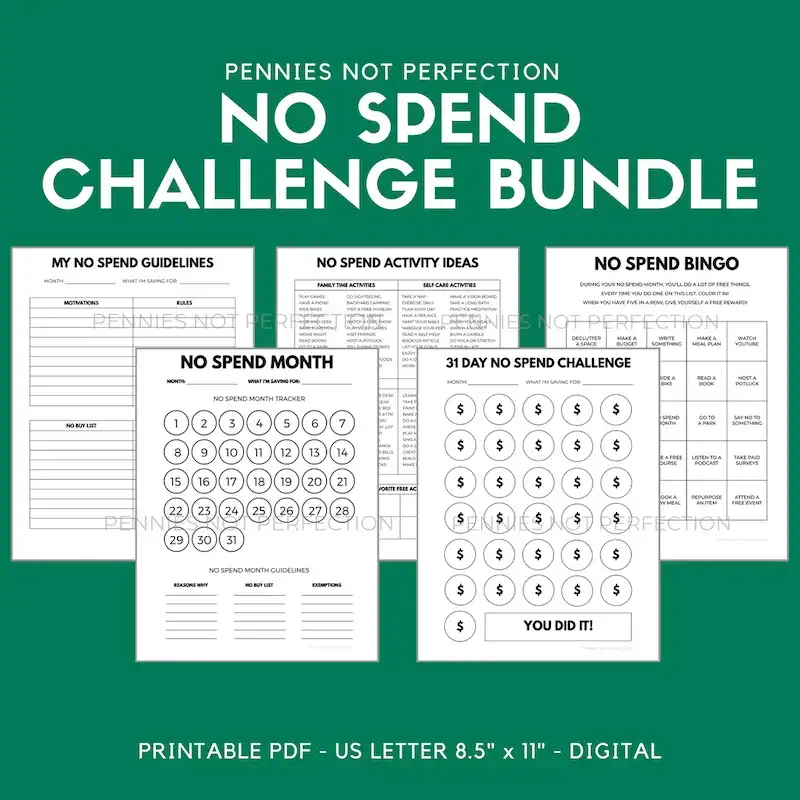

- No Spend Challenge Tips & Printables

- Stop Impulse Buying Cards Printable

This No Spend Month Challenge printable bundle will help make a no spend challenge month easier and more fun.

Trying to Appear Rich Before Being Rich

When you try to look rich before you’ve truly built wealth you will end up being broke.

Trying to keep up with the Joneses (or whoever your rich friends are) can lead to financial trouble.

Overspending on luxury items or services that you can’t afford can result in debt and financial difficulties.

Instead of trying to appear rich you should focus on building wealth over time and living within your means. Doing this will allow you to build wealth so you can easily afford luxuries.

Take care of your finances first and you’ll get the rich life after.

Try to look rich first and you’ll always be scrambling not to feel broke.

Not Being Organized with Your Finances

Not being organized with your finances can lead to many negative consequences.

When you’re disorganized with money you encounter:

- missed payments

- late fees

- credit score drops

And even more! Being disorganized with money means you don’t actually know where your money is going when you get paid.

That’s a fast track to feeling broke even with plenty of income coming in to your bank account.

You can fix this by getting organized and choosing a budgeting system.

To get organized with money you’ll need to do the following:

- Write down all of your bills and due dates

- Set up automatic payments and withdrawals

- Choose a budgeting method you’ll actually use

- Make a plan for paying any debts you have

- Prioritize your money to pay yourself first

Your budgeting style doesn’t have to be complicated. Simple financial methods work.

You just need to have some sort of method or system that makes sure all of your money goes where it needs to be.

Trying to Get Rich Quick Schemes

Ironically, the people who try to get rich quick are often the most broke.

Trying to get rich quick through scams, pyramid schemes, or even playing the lottery is a surefire way to end up broke.

These things often promise the dream of being rich without any of the work. They take your money in exchange for a brief feeling of potential success.

People who try these methods often end up with less money than when they started.

Instead of relying on get-rich-quick schemes, it’s important to focus on slow and steady wealth-building strategies.

These real wealth building methods include:

- investing in index funds

- buying and holding real estate

- starting a business with real income

While it is not flashy, these methods can lead you to actual wealth instead of imaginary riches.

Bad Partnerships & Relationships

Having a bad partnership or relationship can leave you broke.

Whether it’s through divorce, splitting finances, or supporting a partner who isn’t financially responsible, a bad relationship can quickly drain your finances.

Similarly, bad business partnerships that go wrong can also leave you broke.

In both situations you need to advocate for yourself and protect yourself financially.

You should have open and honest communication about finances and make sure both partners are on the same page. If you don’t then you’ll end up working against each other.

Legal agreements and plans for splitting up can also help you in the case something goes wrong.

While you never want a partnership or relationship to go bad, the sad fact is that many do. Instead of being left broke and heartbroken you can make sure you are prepared financially.

Keep Improving Your Finances

There are many reasons why people find themselves broke, but the good news is that there are solutions.

By understanding the root causes of these common financial problems you can avoid them and build a better financial future.

There are many strategies you can use to achieve financial security. No matter which ones you employ it’s important to always keep improving your finances.

You don’t have to be perfect with money you just need to be consistent.

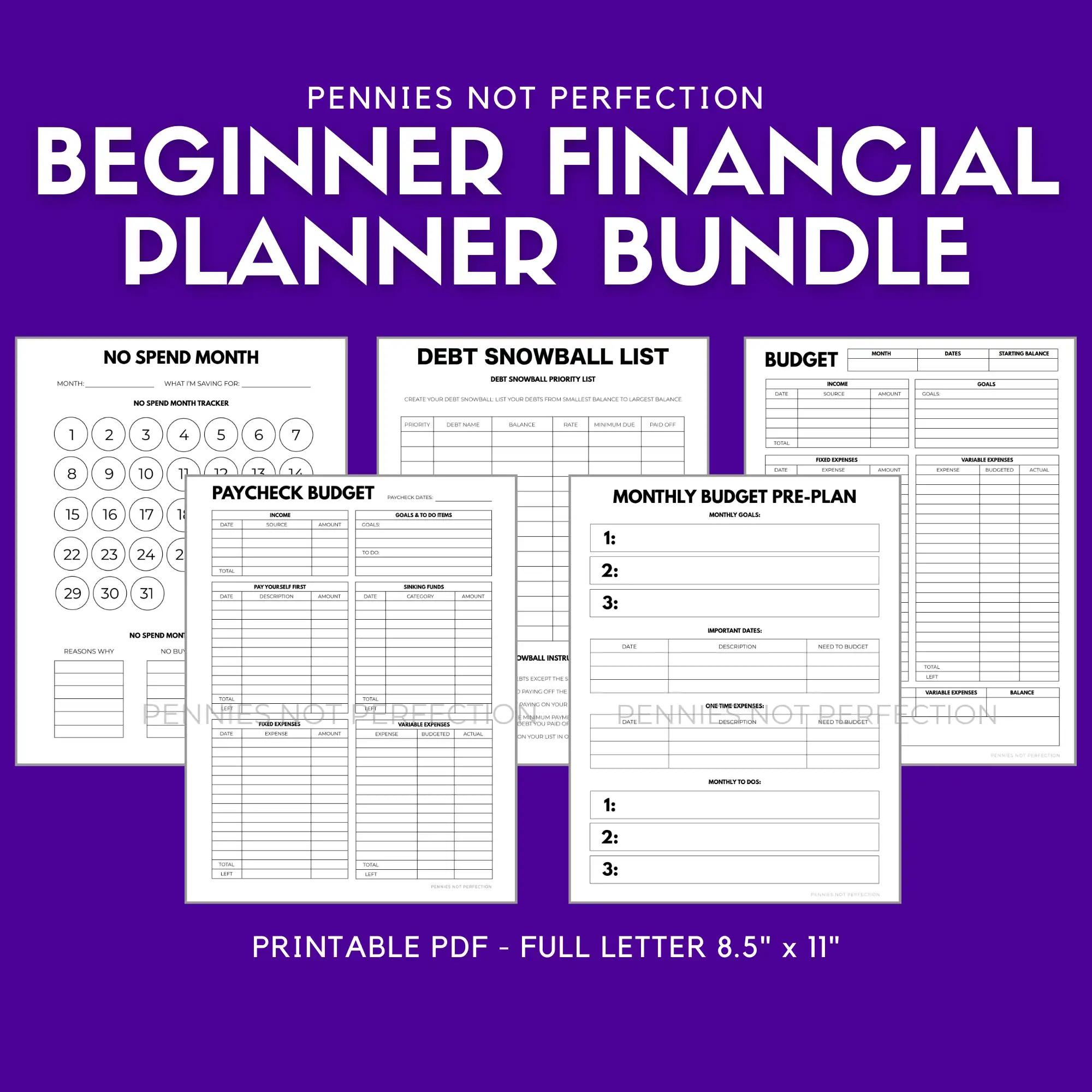

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.