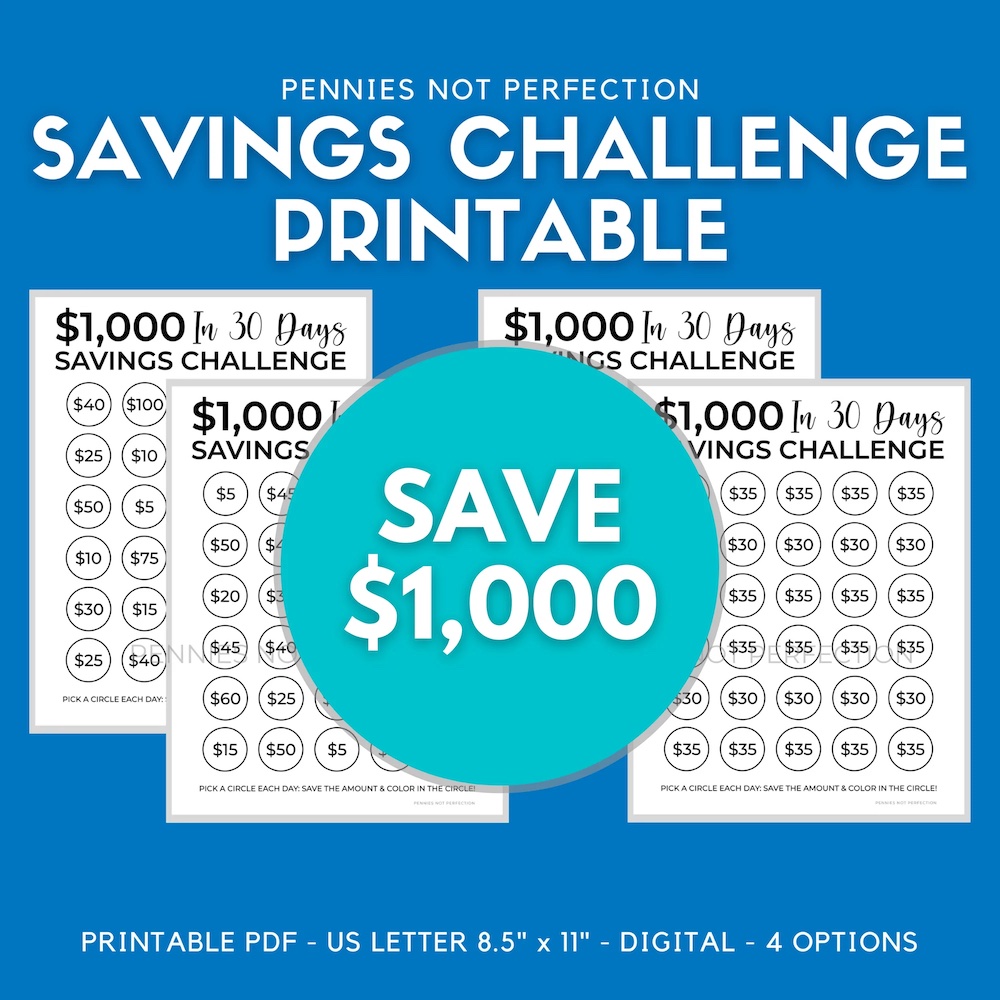

Sometimes you need to pile up cash fast. This $1,000 30 Day Saving Challenge can help you set aside $1,000 in the next month so you’re ready for whatever is in front of you.

Whether you need the money for an unexpected expense or an emergency fund or another reason, savings challenges can be an effective way to save up money quickly.

Beyond just the savings challenge chart we also share some ways to cut costs and stash away that extra money to hit your $1,000 goal.

Save $1,000 In 30 Days

Save $1,000 In 30 Days Challenge Video

The $1,000 In 30 Days savings challenge is all about saving up $1,000 quickly. This challenge has multiple options so you can save a daily amount every day for 30 days. At the end of the month you will have $1,000 set aside for your savings.

This savings challenge is great for many reasons:

- short term so you don’t have to save at this rate forever

- can be accomplished quickly

- gives you a sense of accomplishment early in saving money

- save up enough for a starter emergency fund or emergency need FAST

This challenge can be difficult for many so it might be too much to start with. You can do the next two challenges where you save up for the whole year to get just over $1,000 as well.

Get the $1,000 In 30 Days Savings Challenge HERE!

What is a 30 day saving challenge?

The 30-day savings challenge is a simple plan to challenge yourself to save up $1,000 in 30 days. The printable savings chart linked above will give you a daily amount to save so you are able to follow a plan.

It’s a challenge for most of us (myself included) which is why it’s used when you need to pile up money quickly.

To achieve this goal in one month you’ll have to challenge yourself to make big moves. This might mean not eating out, no shopping, or even adding an extra job or side hustle.

You’ll definitely need to have a budget set for the month and then still go the extra mile to complete the challenge.

$1,000 in 30 days probably seems like a stretch so let’s look at some ways to save money and earn extra during the next month.

30 Day Challenge Success Tips

Want to finish your 30 day savings challenge with $1,000 in hand? Here are a few tips to help you be successful.

Prepare Yourself

Getting prepared for a savings challenge is often the key to success.

Your challenge success actually starts before the challenge date arrives. The things you do to get ready will make it possible to complete the challenge without any spending mistakes.

Some things people do to prepare for a no spend challenge include:

- taking an inventory of the things you already have purchased

- planning out your meals to avoid restaurant spending

- creating a list of fun free activities you can do

- talking to those in your life about the challenge to help you

These are some of the things you can do to prepare for a successful challenge.

Understand Your Motivation

Another key to succeeding is understanding your motivation.

Why are YOU doing a no spend challenge? What are you hoping to accomplish?

Do you want to save money? Stop bad spending habits? Pay off a debt?

Here are a few ways to understand your motivation and use it to complete the challenge:

- journal your thoughts and feelings about spending money before and during the challenge

- create a visual reminder of why you are doing the no spend challenge

- make a list of the things you will feel or do when you complete the challenge

- use a no spend challenge printable to keep yourself on track

Determining your reasons and then reminding yourself of them will help you finish the challenge strong.

Avoid Spending Temptation

The whole point of a no spend challenge is to not spend extra money. This is hard to do because most people spend money constantly without even thinking much about it.

Avoiding temptations to spend money is one of the best things you can do during a no spend challenge.

Here are some things you might want to avoid during your challenge:

- stepping foot in stores

- browsing online shopping websites

- going to restaurants

- driving by fast food restaurants

Depending on how you spend money you might have to change your routine during your challenge. Removing yourself from the places that encourage you to spend money is very helpful.

Work For Extra Money

One things many people do during a no spend challenge is focus on earning money instead.

When you are working more you are less likely to be out spending money. This can also benefit you because you are able to increase the financial impact of the no spend challenge.

Need some money making ideas? Try these:

- Make Money With Canva (10 Ways)

- How to Make Money Selling Stickers On Etsy

- How To Make Money With A YouTube Channel

- Referral Codes To Make Money

You can also just sign up to work more hours or even start a new part time or temporary job. Making extra money will combine with all the money you save for a huge financial push in the right direction.

Ways To Save $1,000 In 30 Days

During your savings challenge you’ll need to cut your spending to save money. Below are some of the ways you can cut spending or save money during the 30 day challenge.

Cut These Items From Your Spending

Obviously you want to cut as much spending as possible during your challenge. Here are some ways you can cut back spending for the challenge duration.

- Cut all eating out. Plan all of your meals to bring lunch to work and not eat out at all for any meals.

- Cut out all discretionary spending. If it’s not planned or in your grocery budget, write it down and wait a month.

- Reduce any entertainment spending. If it’s an event or concert already planned make it an exemption for the month but don’t add anything new.

- Cut your normal grocery budget in half from what it normally is. Get creative with items you already have an things on sale.

- Slash your food budget. If you are able to eat out of your pantry and freezer for a month, consider cutting out all food spending. You could make an exemption for a small amount each week for fresh produce.

- Cut something out in your own budget once you’ve looked through for things that could be eliminated.

Related: Things You Should Stop Buying to Save Money

Use Cash Back Apps

Let’s be honest: you are going to spend some money during the challenge period. It’s not a no spend challenge after all!

Take advantage of when you do spend money by using cash back apps when you spend.

These apps can save you money on purchases and provide cash back every time you spend money. You can also stack many of these and use at least two cash back apps every time you spend money.

Here are my favorite cash back apps:

Make money while you shop online with Rakuten. Get cash back, deals and shopping rewards from your favorite stores when you use Rakuten.

Rakuten – When you shop online Rakuten is the best cash back app available. You’ll get a percentage of your purchase back in cash everytime you shop. You can use Rakuten on most sites and they have a useful Chrome plugin.

Sign up using my referral link for an extra bonus.

With Ibotta, you can get cash back every time you shop online or in stores. Their app makes it easy, fast, and safe to save up to 30%.

Use code vernepp to get a $10 sign up bonus on your first receipt.

Ibotta – With Ibotta’s useful app you can earn cash back when you purchase certain items either in store or online. It’s easy to scan the offers and select which ones you are buying. If you already shop for these items it’s a no brainer to get a coupon that acts as cash back!

Sign up using my referral link for a bonus.

Fetch Rewards is the #1 cash back app to scan your receipts and earn free gift cards.

Use code MV7RR to get free bonus points when you sign up!

Fetch Rewards – My favorite cash back app is Fetch Rewards. You can use this app to earn points that are redeemed for gift cards. Gift cards won’t add to your savings total but you can use them at grocery stores or Target or Amazon and then put that amount aside in your savings instead. All you have to do on Fetch Rewards is scan your receipts – any receipts you have!

Sign up using my referral link for a small bonus.

There are many others and you can sign up for most with a referral code and get a bit of free money in the beginning!

Work On Impulsive Spending Habits

Impulsive purchases ruin budgets and wreck savings goals. If you want to save $1,000 in 30 days then you can’t allow for impulsive purchases.

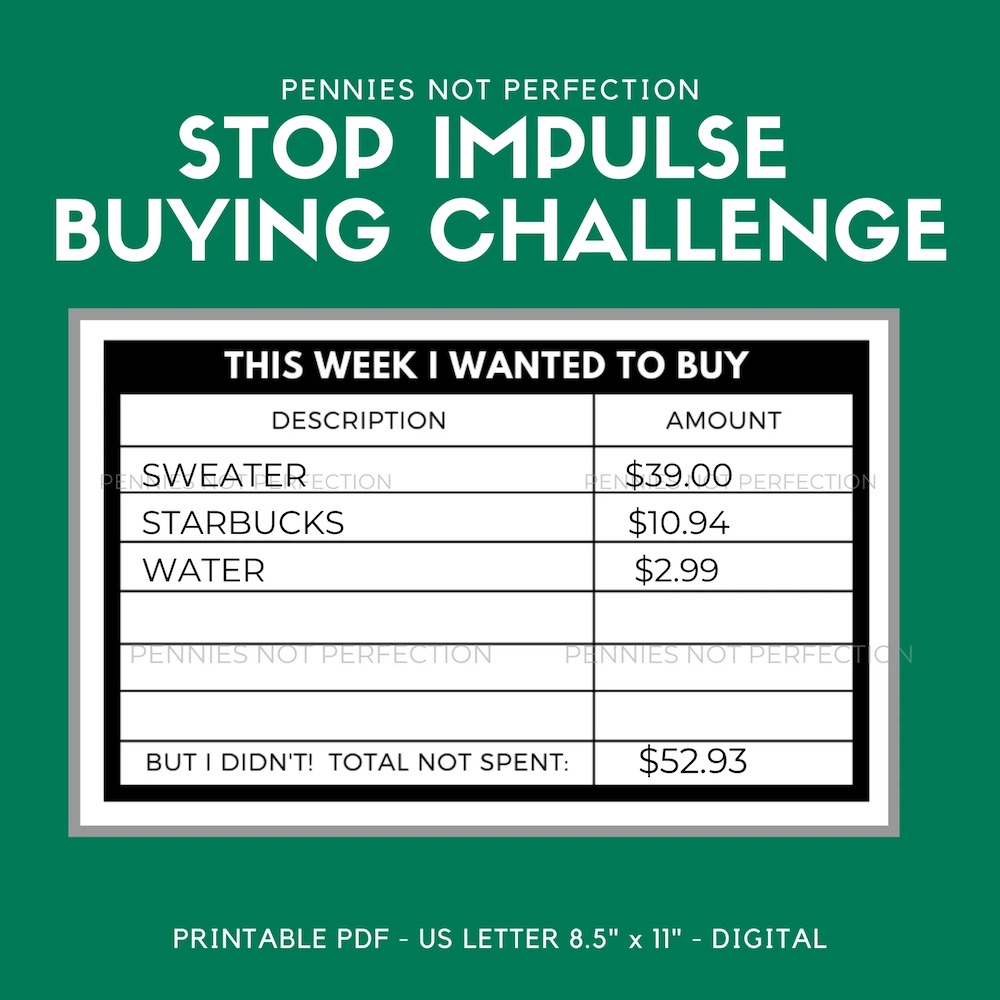

One way to curb impulsive spending habits is to work with tools like these impulse spending cards.

With this impulse spending challenge you write down all of the impulsive purchases you wanted to make but did not during the week. Then you total up that amount of what you would have spent. Move that number into savings.

This one can be hard to do if you have a problem with impulse spending.

But it can lead to savings success and even change your life. This is because it focuses on multiple areas:

- stopping impulse spending

- making conscious spending decisions

- saving money that would have been spent

This tackles multiple areas that can often be a problem when people can’t save money. Because it requires more internal work and effort this challenge can be a bit harder than just saving money.

Get the impulse spending cards in the Money Printables Library!

30 Day Saving Challenge Summary

Saving $1,000 in 30 days is a big challenge for many people. We all have many expenses every month without a lot of wiggle room.

Committing to a 30 day saving challenge to pile up $1,000 will be a lot of work.

But it is possible!

Pick a start date, prepare for the challenge, grab the printable below, and let’s get to saving money!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.