If you want to calculate your net worth there are multiple net worth tracker options available.

Net worth is one of the most motivating things to track during a financial journey. Every debt you pay off, every dollar you save will reflect in your growing net worth numbers.

How To Calculate Net Worth

Calculating your net worth is a very simple equation.

Your assets (what you own) – your liabilities (what you owe) = Net Worth

Assets – Liabilities = Net Worth

Asses are anything you own that has financial value. These things can be cash or something that can be sold for cash.

Assets include things like:

- real estate value

- automobile value

- personal property value

- retirement accounts

- investment accounts

- savings accounts

- bonds

- stocks & mutual funds

- cash value of life insurance

- cash

Liabilities are debts or other outstanding financial obligations that you must repay. It does not include monthly bills unless you are behind on them and owe a debt for back payments.

Liabilities include things like:

- home mortgage

- any other mortgages

- auto loans

- student loans

- credit card debt

- personal loans

To calculate net worth you add up the value of your assets and subtract the value of your liabilities.

The equation to calculate your net worth is simple but there are many ways to actually run the math.

Below are three popular ways to calculate your net worth with my favorite option for each.

Net Worth Tracker App

Calculating your net worth via an app is one of the easiest ways to do it because all of your numbers are pulled in automatically.

Personal Capital is my favorite option for calculating and tracking net worth.

When you sign up for a free Personal Capital account you can see all of your assets and liabilities in one place.

The free and secure net worth tracker allows you to see your net worth in real time. You link your bank accounts, investments, retirement accounts and more so your numbers are updated instantly.

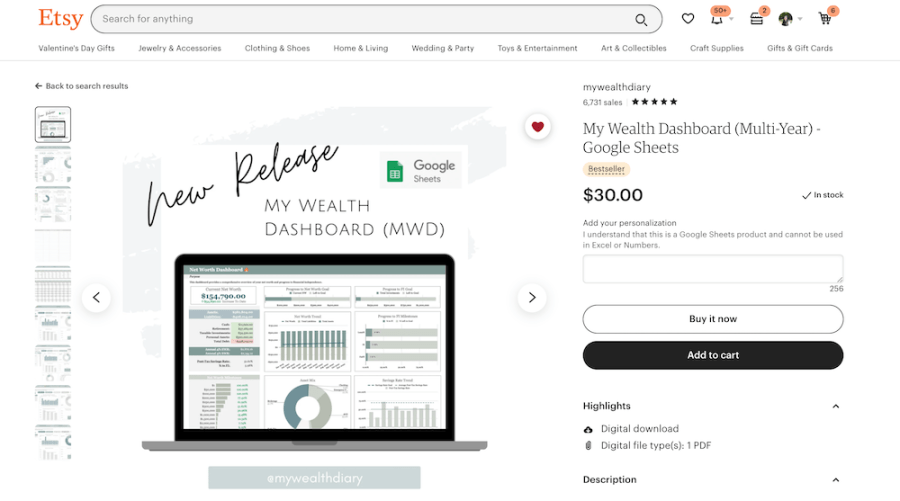

Net Worth Tracker Google Sheets

The best net worth tracker Google Sheets options come from the Etsy shop MyWealthDiary.

In this shop there are multiple Google Sheets based wealth dashboards and net worth trackers. These allow you to track all of your financial numbers in a beautiful spreadsheet.

This is a great option for anyone who wants the numbers calculated automatically but does not want to use an app that connects to financial accounts.

Net Worth Tracker Printable

As a paper planner I love to track my net worth the old fashioned way – writing it all out on paper!

I created this simple Net Worth Tracker Printable that can be used each month for a financial health snapshot.

With this printable net worth tracker you can write out your net worth numbers and do the calculations yourself.

This method is definitely the most time consuming but it is also affecting a different part of your brain when you walk through writing out these numbers.

It is a good exercise to do at least once even if you plan to use an app or spreadsheet in the future.

Writing out the numbers can be eye opening and start you down a new financial journey like paying off your mortgage.

Why Is Net Worth Important?

Net worth is one of the most important numbers indicating your financial health.

This number gives you a quick snapshot of everything you owe and everything you own.

Even more important is the value that net worth gives you as you track it month over month.

Tracking your net worth over time gives you an effective way to see if you are moving in the right direction financially. You will see the number decrease if you take on more debt or increase as you build wealth.

When you are paying off debt your net worth will be increasing. When you are investing your net worth will be increasing. Seeing the numbers grow is very motivating for many people.

Calculate Future Net Worth

If you want to calculate your net worth into the future there are calculators online that can run those numbers.

This net worth calculator at Bankrate allows you to enter your assets and liabilities to calculate your current net worth. Then it also estimates how your networth could grow or decline over the next decade.

If you are paying down your debt and increasing your investments this calculator will show drastic net worth growth in your future.

Building wealth and growing your net worth is not complicated but it does require consistent action.

How To Increase Net Worth

Many people are shocked to discover their net worth for the first time. The number is ofter much lower than you would want. If you’re in debt then the number is often negative.

There are a few ways to increase your net worth:

- Pay off debt. Reducing your liabilities (debt) is one of the quickest ways to improve your net worth. This is especially important with things like credit card debt that have a high interest rate and send you backwards financially.

- Increase your savings. Increasing your savings rate can help you improve your net worth. The more money you save the higher your net worth will grow and the more money you have to either pay off debt or invest.

- Invest your money. Investing your money so it will grow and beat inflation is one of the most important things many people can do. After building an emergency fund you should invest to grow your net worth.

- Set up automated savings. Many people struggle to save and invest more money until they automate the process. It’s much easier to save or invest money that never hits your checking account. You can set up automated transfers each month so you grow your net worth without thinking about it.

- Budget and spend less. The more money you have the more you will grow your net worth. Budgeting and spending less is one way to find that extra money for building wealth. Find a budgeting method you like and then budget your money every time you get paid.

Those are just a few ways you can work to increase your net worth.

Remember that net worth is something that is built over time through consistent financial habits. You don’t have to be perfect to do it you just need to consistently move in the right direction!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.