Are you wishing for student loan forgiveness or are you looking for tips for paying off student loans? No matter how you plan to eliminate student loans your life will be better off once they are gone.

There are a few personal finance milestones worth celebrating. These milestones include paying off credit card debt, paying off student loans, getting a job, becoming debt free, etc.

All of these financial goals take work, time and sacrifice which makes them worth celebrating.

My Experience Paying Off Student Loans

Back in 2013, I paid off my student loans!

I was thrilled about paying off all the loans in my name. I worked hard to pay off all my loans and was elated over the experience even though it took two years of hard work and sacrifice.

Unfortunately years later I also ended up paying off parent plus loans I did not expect to pay. It took me just over two years to pay off $43,000+ in debt that time and I documented it on my YouTube channel.

I’ve learned a lot about paying off student loans over the years.

Paying off $22,000 in student loans and another $43,000 in parent plus loans has taught me a lot of knowledge about paying off debt.

Paying off student loans is not just about the debt or the interest rate on that debt. It is often more about achieving the feeling of being debt free and eliminating a burden.

It’s easy to wait around and hope your loans will be forgiven. But the hard work of paying them off yourself is worth it.

In my case both times I wanted to be free from the burden and the feeling of being trapped by debt.

Tips For Paying Off Student Loans

The following tips for paying off student loans are ways I paid off my own debt.

These tips helped me knock out my debt quickly on a relatively low salary both times I paid off debt. You can do the same by following these tips to pay off your student loans!

Create a debt payoff plan.

The first step of paying off your student loans is creating a debt payoff plan. You need to find out how much you owe and who you owe.

You should list out all of your debts, the payments, and then create a plan for how to pay off the debts.

Read more: How To Set Up A Debt Snowball

Check your repayment options.

Federal loans give you several different loan repayment options.

You can potentially lower your monthly payment with these plans or you could get an extended repayment plan that will extend your loans another decade or two in order to take the pressure off you.

You can also use these repayment options to accelerate paying off your student loans.

Create a more aggressive debt repayment plan.

Making a plan to get out of debt faster by being more extreme in your budget cuts is the next step.

Having a debt repayment plan is important but getting more aggressive will get you out of debt faster. You will want to go faster than you would just paying minimum payments toward your student loans.

Go “Dave Ramsey style” and attack your student loans like a person on a mission.

Live on less.

It’s smart to live on as little as possible when you first graduate college.

You can use this time to start paying your student loans with the extra money in your budget. Keeping your expenses low will allow you to make bigger payments toward your student loans. This will ultimately eliminate them faster.

Do everything you can to save money like living with roommates, enjoying cheap weekends and driving a beater car. There are lots of things to do instead of spending money!

Read more: Frugal Living Tips

Start small if you need to start small.

Instead of putting off your loans for years and years while you wait for the big salary, make small payments from the time you start working.

Pay down debt from the very beginning of your earnings and plan to just increase it as you earn more. This is a much better strategy than delaying your payments.

Only have $10 to contribute? That’s ok! Follow me on my Transfer Tuesday series to see how small amounts add up over time.

Track your progress.

Tracking your debt payoff progress helps you achieve your goals faster.

I actually started this blog in order to track my debt payoff progress. You can track your progress with your own blog or YouTube channel or with a software program or with old fashioned pen and paper. You can use a program designed to track debt payoff to both plan and track your debt payoff progress.

Seeing your payments add up over time will help you know you are making progress and motivate you to continue.

Budget to afford your student loan payment.

It’s easy to create a budget that leaves your student loan payment until the end… but don’t do that!

Make sure your personal budget leaves room for your student loan payments. This might require some sacrifices and changes in the way you live to allow for frugality in order to pay your student loans.

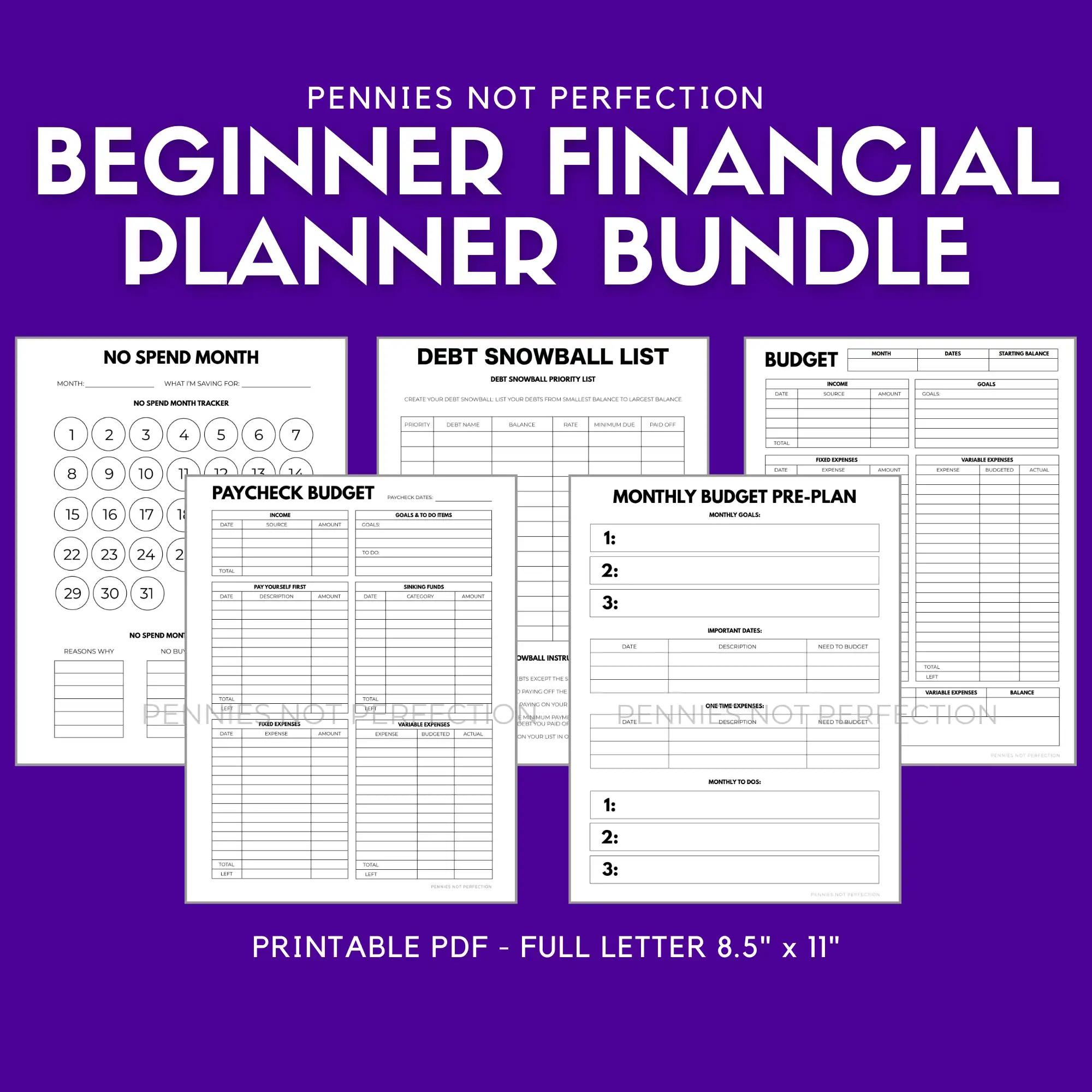

If you need help with budgeting, download any of my budgeting printables or check out the following budgeting posts that can help:

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

Set up automated payments.

Setting up automated payments is a great financial strategy for many people.

You might not miss the money as much if you have it set up to come out of your paycheck as quickly as possible. Some companies also offer benefits for this type of payment.

As a bonus, thanks to the automated nature, you’ll never forget or be late on your student loan payment.

Pay more than is due.

It sounds simple, but to eliminate student loans you have to pay more than is due.

The fastest way to eliminate your student loan debt is to pay more than what you owe each month. Want to do it faster? Pay more!

In the beginning you might just set up automated payments for a little bit extra each month. Work to increase this each month until you’ve doubled or tripled the payment that is due.

Pay the highest interest rate first.

I paid off my student loans with the highest interest rate first.

Those loans were costing me more since they also happened to be my biggest loans. It felt like it took a long time but in the end it saved me money. I knew that if I paid them off and was only left with loans at a 2% interest rate it wouldn’t be that big of a deal.

If you have high interest rate debt you should tackle that first before other debt.

Send in big chunks when you can.

Got a bonus? Received money for your birthday? Paid for a side gig?

Use that extra money to make a one time payment toward your student loans.

Any time I had extra money in my bank account not destined for something else I would use it for paying off my loans. It all adds up!

Make more money.

Finding ways to make extra income will help you tremendously when you are paying off your student loans.

I used extra income from my blog and babysitting jobs to make extra payments toward my student loans. Whenever I could work extra on the weekends I took the chance so that I could throw the extra money toward repaying the student loans.

Need some ideas or motivation? Check out these money making ideas:

- Make Money With Canva (10 Ways)

- Make Money On YouTube Without Showing Your Face

- How to Make Money Selling Stickers On Etsy

- Things To Sell On Etsy For Extra Money

Avoid taking on more debt.

One of the best tips for paying off student loans is to not take on any more debt. This will allow you to focus instead of going in the wrong direction.

If you are already living with student loans you should avoid taking on more debt. This is especially true if you have a lower income.

You should evaluate your needs and choose to save up to pay for anything rather than getting a loan. Adding a huge car loan or a mortgage immediately can make living with student loans harder. The more debt you have the more your income will feel like it is shrinking.

Manage all your money well.

In order to successfully live with and pay off student loans you should manage your money well.

Managing all your money helps you successfully manage your student loan repayments as well since it will be just a smaller part of your overall financial health. If you need more help try using the free money management tools available online like Personal Capital.

Chart your path to financial freedom by tracking net worth, spending, & investments in one easy to use FREE dashboard.

Learn from others who have paid off student loans.

Learning from others will give you a lot of great tips for paying off student loans.

Read blogs from people who have paid off their student loans. These people are the best possible source for ways to live with and destroy student loans.

Try reading the ebook Destroy Student Debt: A Combat Guide to Freedom, written by a fellow blogger who got rid of $90K in student loan debt from Harvard. Watch YouTubers who have paid off debt. Find ways to consume content that helps you pay off debt.

Stay motivated.

Paying off debt sucks. There is no way around it. It’s hard to stay motivated and continue to follow your plan when it feels like your money is disappearing with no benefit.

Stay motivated by reading great books about paying off debt or listening to podcasts or talking to friends and family about achieving your debt payoff goals.

Remember, never give up! Paying off your debt is rewarding and a great thing to do for yourself and your future.

It’s possible to live with student loans and still make progress on paying them off, but you must be aware and intentional about your plan. Once you create your debt payoff plan then you need to be diligent about working the plan and not falling off.

If you’re serious about paying off debt, these tips and tricks for paying off your student loan debt.

Between all of these tips and your own desire to live with student loans and eventually eliminate them, you’ll be successful in your endeavors. Good luck living with student loans!

Good luck with your own debt repayment! You can do this!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.