If you want to achieve a financial goal then you’ve probably been told you need to budget. Why is budgeting the first step for financial goals? What is the purpose of a budget?

Does budgeting really help? Can it help you pay off debt, save money, or buy a house?

Yes!

After years of financial mistakes I learned how powerful budgeting could be and it helped me pay off $83,000 in debt, buy a house, and build a successful business too.

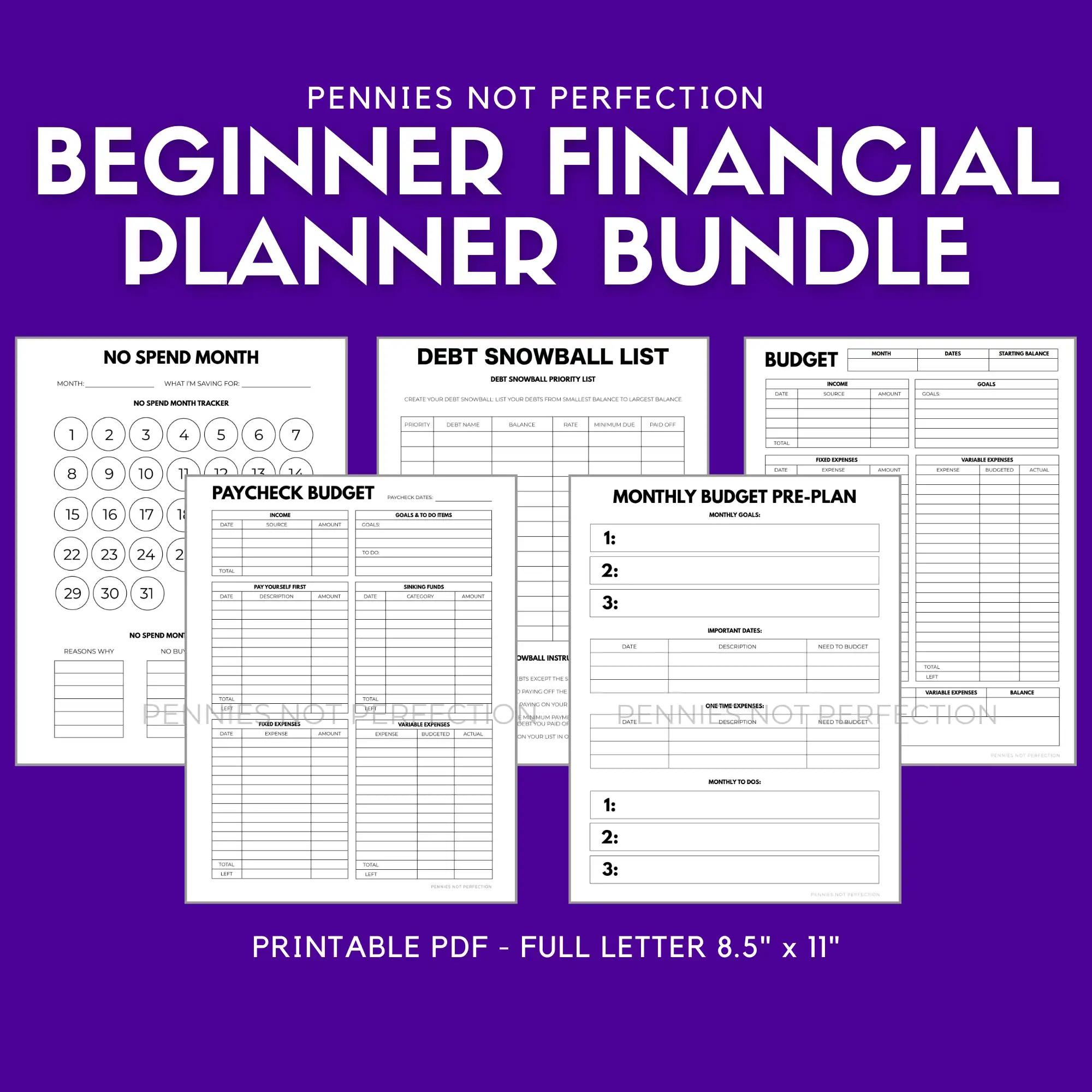

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

In this post I’ll share everything you need to know about budgeting and why it is so important to your financial goals.

We will look at:

- the benefits of budgeting

- ways to budget your money

- how to make a budget as a beginners

Ready to learn about how budgeting can help change your life financially? Keep reading!

What Is The Purpose Of A Budget?

If you found this post then you probably want to know what is the purpose of a budget? What is the point of budgeting? What is the purpose of a budget?

The purpose of a budget is to plan and track your money so you can achieve your financial goals.

Budgeting is the process of improving your financial health. Budget help you control your spending and focus on your priorities.

Budgeting can also be called many other names:

- cash flow plan

- spending plan

- income allocation

No matter what you call it, giving your money a purpose via a budget is an important part of managing money well.

Budgeting helps you plan your finances so you can control what your money achieves. Without a budget you are less likely to reach big financial goals.

Budgeting might not be as glamorous as things like investing but it’s an important foundation for financial success.

Main Purposes on A Budget

Budgeting helps you plan and control your spending while achieving your financial goals. But what does this really mean?

Let’s look at the main purposes of having a budget:

- Grow your savings

- Control your spending

- Cut back on money wasters

- Achieve big financial goals

- Get out of debt

- Eliminate financial stress

- Grow your net worth

Grow Your Savings With Budgeting

Budgeting gives you a financial roadmap to increase your savings.

Budgeting is often the key piece to achieving savings goals like saving up an emergency fund or down payment.

Creating a budget can help you save money more easily by identifying where your money is going and how you can make improvements to your spending. This allows you to redirect your money toward savings goals.

Creating a budget and sticking to it often reveals areas where you were spending more money than you thought. Through budgeting you can identify these areas and redirect your money to savings.

Personally when I first started budgeting I realized I spent a lot of money on areas of life I didn’t even care about.

Then when I started budgeting with my husband we discovered we spent hundreds more on eating out than we expected. With a budget we could still go out to eat but also save hundreds of dollars toward our savings goals.

Budgeting helps you identify areas of spending that add up quickly but don’t necessarily improve your life that much. This spending can then be turned into savings.

Budgeting also allows you to put your savings goals FIRST.

Instead of spending and then saving what is left you save money first and then spend the rest. This method of paying yourself first allows you to prioritize savings and make sure you save money.

Budgeting makes sure your savings grow by making it a priority.

Control Your Spending With A Budget

If you aren’t tracking and measuring your spending then you have little hope to control it. Budgeting helps control spending.

When you implement a budget into your life you then have to track your spending to make sure you are following and updating the budget. This helps most people control their spending.

Budgeting often gives people a shock at first because many of us have no idea how much we are spending in certain areas.

Despite limited income most of us spend money without thinking too much about it. I often see new budgeters SHOCKED by how much money they are spending every month on things like coffee, eating out, shopping, or other impulse purchases.

It’s too easy to spend money these days with apps and cashless spending.

The process of budgeting helps you identify all of these areas where you are wasting money without realizing it.

Budgeting keeps your spending in check. It allows you to spend in areas you care about but within comfortable constraints so you can also achieve other financial goals.

When you are budgeting your money you will be more in control of your spending.

Achieve Big Financial Goals With Budgeting

Budgeting helps you achieve big financial goals.

When you create a budget you are creating a plan for your money. Part of that plan will include your big financial goals that take time to achieve.

Writing down your goal and then breaking it down over many different budgets will allow you to work toward achieving something larger.

There are many different big financial goals you can achieve with budgeting:

- saving a down payment

- growing an investment portfolio

- saving a house downpayment

- paying cash for a car purchase

- buying a luxury item you want

- going on an expensive vacation

There are all sorts of different financial goals you can achieve with budgeting.

These types of financial goals are expensive and require planning via budgeting.

Get Out Of Debt With A Budget

One of the first times many people use a budget is when they are trying to get out of debt.

Personally I got serious about budgeting once I made a debt payoff plan. I knew that I needed to better control my money if I was going to pay back tens of thousands of dollars in debt.

Eliminate Financial Stress With Budgeting

Another purpose of budgeting is to eliminate financial stress of any kind.

Budgeting gives you a plan to follow and that can eliminate many stresses.

When you budget you will no longer worry about missing bills. You don’t have to stress about not being able to hit financial goals.

Because a budget prioritizes things for you with money you are able to take care of important things first. If you don’t have enough money for everything you can rest assured that the most important things are already covered.

The longer you budget and the better you get at budgeting you will notice you have fewer and fewer financial strains in your life.

Even just creating a budget and having a plan can eliminate many worries from your mind.

Budgeting makes life less stressful.

Growth Your Net Worth With Budgeting

One of my favorite things about budgeting is that it allows us to grow our overall net worth.

I know that by increasing my net worth I’m securing a more stable financial future for my family. Budgeting my money means I’m always working toward net worth growth whether that is through paying down debt, investing my money, or buying assets that appreciate.

When you create your budget you can send a percentage of your money toward things that will grow your net worth. Maybe you invest 10% of your income into index funds every paycheck for example.

I like to track my net worth through apps like Personal Capital. The best thing about something like this free app is that it can double as your budgeting and net worth tracking platform. It does it all!

Chart your path to financial freedom by tracking net worth, spending, & investments in one easy to use FREE dashboard.

Ways To Budget

How To Set Up A Budget As A Beginner

Are you ready to start budgeting?

In this video I show you the basics of setting up a new budget along with a few budgeting tips. If you’ve never done a budget before I highly recommend you watch this video before you start.

Creating your first budget can be difficult as a beginner.

You can save yourself time by using budgeting worksheets or a financial planning app that guides you through the process.

Whichever method you choose to use, the basics of creating your first budget are the same.

You need to figure out how much money you are bringing in and how much money you are spending.

Basically you want to give the money you bring home an assignment so you can better optimize your budget to achieve all of your financial goals.

Here are the steps to creating your first budget:

- Gather everything you need for creating a budget

- Write out all your monthly bills

- Grab a calendar and layout your bills and paychecks on it

- Categorize a few months of previous spending

- Set some new reasonable goals for spending

- Plan out your sinking funds for big expenses

- Add all your expenses up and compare it to your income

- Track your spending through the month to compare

You can do this same process shown on the video with either pen and paper, a budgeting printable, a spreadsheet or a budgeting app.

The process is what matters most, not how you write down and track the actual numbers.

How To Set Up Sinking Funds

One concept that is often new to people when they start budgeting is sinking funds.

Sinking funds are saving accounts with a purpose and they make budgeting much, much easier.

Sinking funds are accounts you save into regularly for spending on expenses that are irregular expense, non-monthly expenses, unpredictable or big one time expenses. It’s a mini savings account for an expense you know you’ll have in the future.

Not sure which categories to include for your sinking funds? There are many different sinking fund categories you might consider saving for that are not regular expenses.

You set a little bit aside each month until you hit your goal… and then you spend it!

Sinking funds make saving for these hard to budget items strategic and stress free. This is one of the ways a budget can eliminate financial stress from your life. Planning ahead for big expenses makes them much easier to handle.

Sinking funds are designed to let you spend without stress or worry. It’s one of the best budgeting tips most people ever learn.

Need more? Check out these budgeting tips for beginners.

More Budgeting Questions

Not sold yet on whether a budget is right for you? Check out some of these common budgeting questions and answers.

What is the purpose of a budget in accounting?

The purpose of a budget in accounting is to create a financial plan for the future that anticipates all income and expenditures to align with business goals.

I come from a family of accountants (siblings and parents!) so I’ve heard a lot about budgets in accounting terms. While it’s similar in the fact that it is a plan for the future, there is a large difference in personal budgets versus a budget in accounting.

One purpose budgets in both accounting and personal finance share is the purpose of moving toward achieving defined financial goals.

What is the purpose of a budget for a family?

Budgeting works for all the purposes listed above whether you are budgeting for one person or a family. But budgeting has a few more benefits when you are doing it for a family.

Family budgets accomplish the following:

- makes sure every family member’s needs are taken care of financially

- lowers the risk of divorce over financial conflicts and stress (a leading cause of divorce)

- eliminates confusion and helps get everyone on the same page

- holds all family members accountable to the same standards and goals

Budgeting can be part of the glue that keeps a family together. It’s a way to make sure that all incoming money works for all family members.

What are the disadvantages of budgeting?

Budgeting can help you achieve success financially but it’s not without downsides.

There are many cons to budgeting including:

- time spent creating, tracking, and reconciling your budget

- less flexibility to do something spontaneous with your money

- fatigue over working toward big financial goals over long periods

- shame and guilt over not following the budget or blowing it entirely

There are many ways that budgeting can actually contribute negatively to someone’s life.

When this happens it is always a good idea to take a step back and maybe take a break from budgeting. If you’ve been on a very strict budget or doing a no spend month then you probably need to loosen up and spend a bit more. Taking breaks can motivate you to return again later with a better mindset.

What are the basic elements included in a budget?

Budgets can be as simple or as complicated as you need them to be.

The basic elements of budgets generally include:

- income sources

- fixed expenses

- variable expenses

- big financial goals

Those are the basics when you are creating a budget. Depending on your financial goals that will also include things like emergency fund savings, paying down debt, saving for real estate and more.

Budget Resources

Now that you know the purpose of a budget and all the benefits, you probably are ready to get started!

Below are some budgeting resources that can help you create and maintain a budget in your journey to financial success.

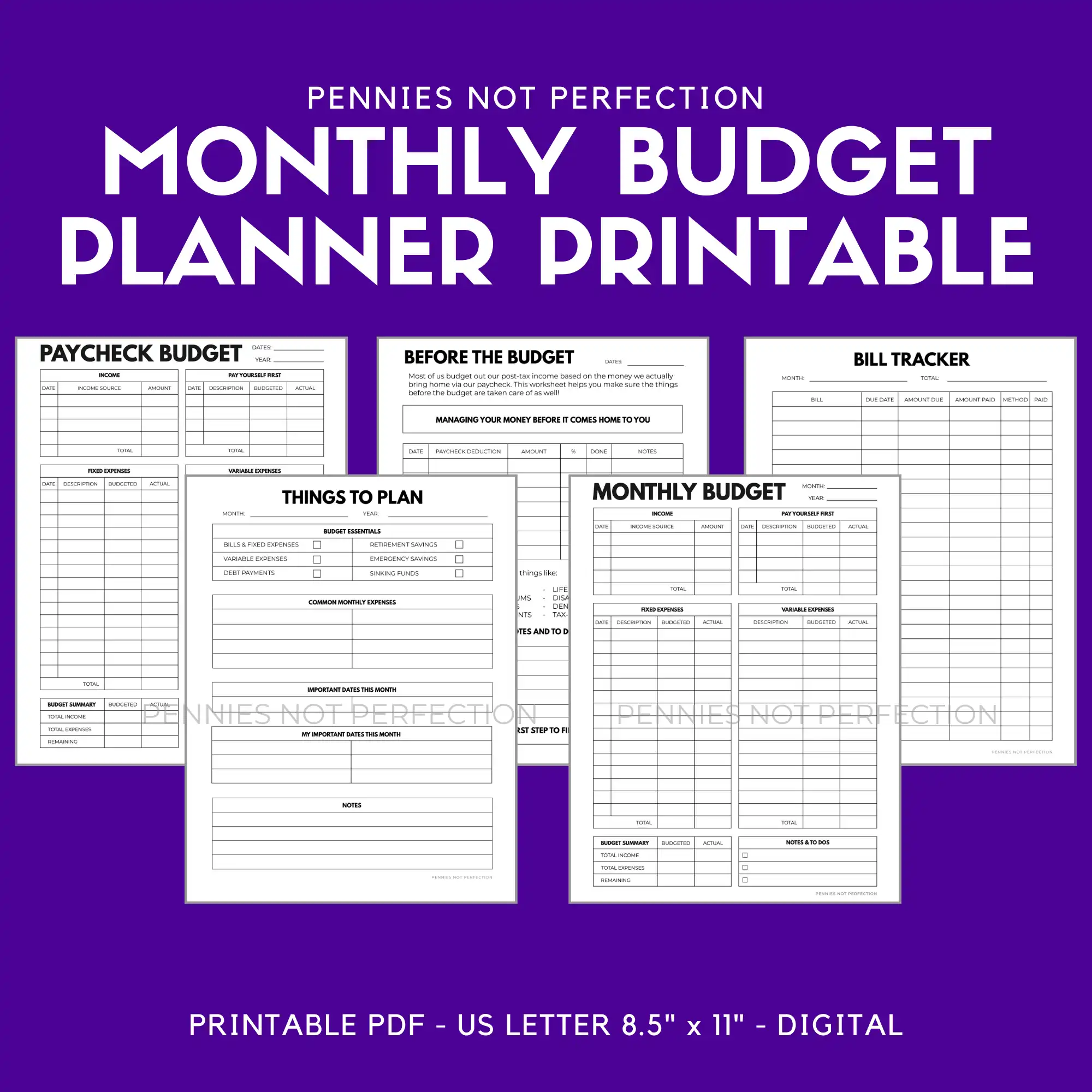

This monthly budget printable is a grouping of everything you need to plan and track your monthly budget. These monthly budget worksheets are designed to help you keep your budget on track by writing it down each month and tracking where your money goes.

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

Chart your path to financial freedom by tracking net worth, spending, & investments in one easy to use FREE dashboard.

I want you to get $275 for opening a SoFi savings account.

Earn up to 4.50% APY & pay no account fees with SoFi's HYSA!

Rocket Money empowers you to save more, spend less, see everything, and take back control of your financial life.

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.