Over a year ago I paid off all my debt and embarked on living life without debt.

After living a debt free lifestyle for the last year I’ve learned several lessons I want to share with you.

Debt Free Lifestyle Lessons

After the past year I’ve learned a few lessons about living with zero debt.

While I’m not completely opposed to debt and understand its necessity in some cases, I can’t deny the benefits of being debt free.

Here are a few things I’ve learned over the past year of living without debt payments:

No Debt, Less Stress

Having no debt is way less stressful than having debt.

Being debt free is much less stressful because you have fewer payments and deadlines to worry about. You don’t have to worry about not being able to pay a bill.

It’s also less stressful because you don’t have to worry about earning extra money to pay off debts.

Without debt, your monthly spending needs are lower. Without debt payments in your budget you can earn less money and still have a great lifestyle.

I worked really hard to earn extra money to pay off my debt. I worked overtime, started a side hustle, and spent many hours working to pay off debt.

Now that I’m debt free? I can work less because I don’t need all that extra money just to service debt payments.

More Options For Your Money

You can do so much more with your money when you are debt free.

Without debt your income is not tied to debt payments. This allows you to use it for other things that probably mean more to you than paying back debt.

After paying off our debt we were able to fund Roth IRAs, save for a new car and home, invest, have a baby, go on vacations, and more.

Having no debt gave us more opportunities to use our money to build financial independence.

When you are debt free you can put income towards a better foundation for your future – whatever that looks like for you.

Less Debt, More Freedom

You have more freedom without debt.

This was the number one reason I personally wanted to pay off debt. I highly value freedom in all areas of my life.

Debt can feel like chains that hold you back from doing the things you want.

Paying off debt and living a debt free life can bring you more freedom.

Without debt, you can choose a job or career that aligns with your values and priorities, rather than working just to pay off debts.

The freedom to make choices based on what you need and want in life comes when you have fewer obligations like debt.

Going Back Into Debt Is Easy

It’s really easy to go back into debt.

Paying off debt was hard and living a debt free lifestyle is even harder. Everyone and every system encourages you to go back into debt.

You can add debt back into your lifestyle at any time if you aren’t careful.

Don’t want to wait to save up for something? Debt is there to “help” you get what you want. Credit cards. Car loans. Pay later programs. It’s all designed to give you instant gratification where you forget about the debt you’ve accepted.

Avoiding debt actually takes planning and conscious decision making. You have to plan sinking funds and save up money to get the things you want.

You have to be active in your financial life in order to stay debt free.

If you have paid off debt and decide it’s not that much better then you can easily slip back into the “normal” lifestyle of having loads of debt. No one would blink twice.

Going into debt is very, very easy.

It’s also something I plan to try and avoid. Having one year of living without debt was amazing and I’d like to have many more.

Debt Free Motivation

Want to get inspired to pay off your own debt and live life without the burden of debt? Check out the following resources!

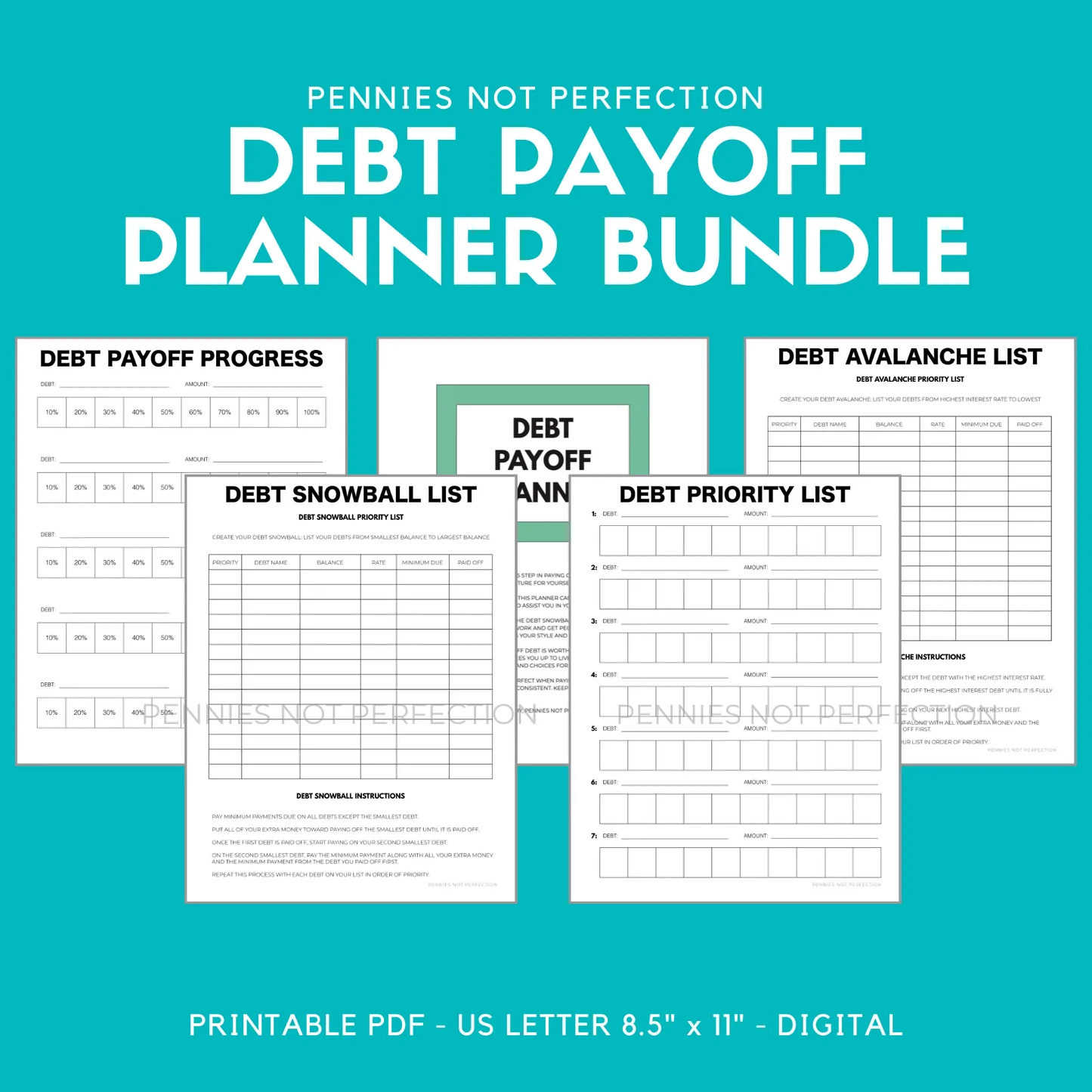

A Debt Payoff Planner Bundle designed to help you track the progress you are making paying off debt during your financial journey. Including:

- debt payoff planner cover, overview, and tracker pages

- debt snowball & avalanche payoff priority list setup and instructions

- debt payment trackers & 4 debt payoff coloring trackers

- debt priority list & yearly debt payoff progress tracker

These debt payoff printables will help you get organized to pay down balances:

- Debt Payoff Planner Bundle Printable Bundle

- 30 Day Debt Payoff Challenge (Pay Off $1,000 In 30 Days)

- Debt Payoff Progress Tracker Printable

- FREE Debt Freedom Chart

And these posts will inspire you to keep going when you feel like quitting.

- 10 Tips To Pay Off Debt

- 111 Quotes To Motivate Your Debt Free Journey

- 10 Best Reasons To Get Out Of Debt

You can definitely pay off debt and live without it. You’ve got this!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.