Are you considering opening a Roth IRA? These powerful retirement accounts can help you save for retirement and become tax-free millionaires, but there are a few things you should know before opening an account.

A few things you need to consider:

- Roth IRA eligibility

- account rules Roth IRA

- your personal tax situation

- contribution limits

- investment options

Not in the mood to watch the Roth IRA video? Keep reading for the top things to consider when opening a Roth IRA.

What Is A Roth IRA?

First, what is a Roth IRA and why is it worth your time?

Roth IRAs are individual retirement accounts that allow you to take advantage of after-tax benefits in order to save for retirement.

You contribute to your Roth IRA on an after-tax basis, meaning you put in money that you’ve already paid taxes on for the year. Then that money grows via investments and you are able to withdraw it without paying taxes again.

They are hugely popular and help many people become “tax free millionaires” later in life.

Want to learn more about Roth IRAs? Check out these helpful guides:

Roth IRA Eligibility

The very first thing you need to know about Roth IRAs is whether or not you can even open one.

The IRS.gov website provides all of the information you need about Roth IRAs including eligibility.

Here are a few things to know about Roth IRA eligibility:

- Roth IRAs are individual retirement accounts and can only be opened in one person’s name.

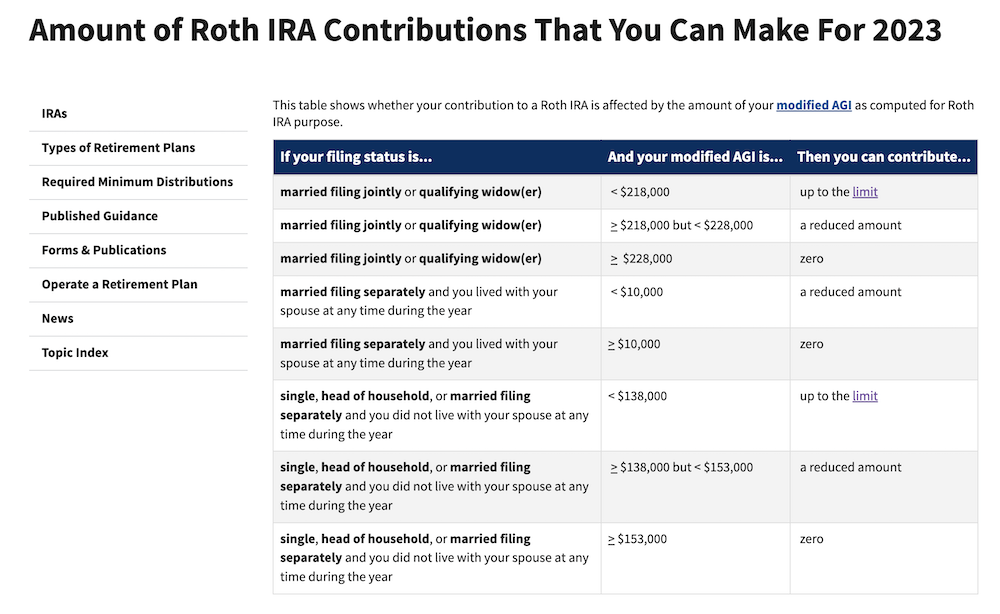

- There are rules about who can contribute and how much they can contribute, based on your AGI (Adjusted Gross Income).

- You should verify you are eligible to open a Roth IRA before beginning the process of opening an account.

- There are limits on the amount of money you can earn in order to qualify for contributing to a Roth IRA. These limits change every year, so double check the new details yearly.

Account Rules

Roth IRAs have a lot of rules that govern both what you put in and how you take the money out.

Roth IRAs have specific rules and laws attached to them, so it’s important to understand what is allowed and what is not.

If you want to open a Roth IRA, make sure you know the following:

- Familiarize yourself with the rules about withdrawing your money, both the retirement age (59 and a half) and any minimums.

- Learn about circumstances that allow you to withdraw money before retirement age.

- If you are a high earner, investigate the rules and details around backdoor Roth IRA contributions.

The IRS has resources available on their website to help you understand the rules of a Roth IRA including information on distributions.

Personal Tax Situation

One thing you need to know before opening a Roth IRA is your own personal tax situation.

How much money do you make now? What tax bracket are you in? What do you expect these to be in retirement age?

Consider your personal tax situation when deciding whether a Roth IRA is the right choice for you.

Some things to know and evaluate:

- Does the Roth IRA tax-free growth benefit you as much as a traditional 401k?

- How will your tax situation change when you transition from working to retirement?

- Will you “earn” more while working or during retirement?

- What other retirement accounts will you be utilizing?

Think about your current and future tax brackets and earnings when deciding which account to prioritize.

Contribution Limits

Another thing to know before you contribute to a Roth IRA is the contribution limits for the year.

Luckily these are easy to find via IRS.gov or brokerage sites like Vanguard.

Remember this:

- The maximum contribution amount for a Roth IRA changes every year, so be sure to check the current limit before opening your account.

- Your contribution limit is based on your modified AGI and your tax filing status (single, married filing jointly, etc.).

- Make sure you are aware of the contribution limit for the year in which you are opening your Roth IRA.

- Make a plan to max out your Roth IRA but do not over-contribute based on your eligibility.

- If your income doesn’t qualify for Roth IRA contributions you can investigate the backdoor Roth IRA strategy.

Investment Options

Once you’ve opened up a Roth IRA you will have to select investments within the account. Your investment strategy might be something to research before opening your account.

- When opening a Roth IRA, you have a variety of investment options to choose from, including stocks, bonds, and mutual funds.

- Do your research and choose the option that best fits your financial goals and risk tolerance.

- Most brokerages have staff that can help you evaluate your investment options and many of these cost nothing to you. There are also lots of robo-advisor options that pick investments based on your risk tolerance.

Educating yourself about your investment options will allow you to feel more confident about your selections inside your Roth IRA.

Maxing Roth IRA Contributions

Some people contribute their entire Roth IRA amount on the first day of the year. Many others find it easier to contribute throughout the year in order to max it out.

If you are planning to max out your Roth IRA throughout the year, you might want to use a savings challenge tracker.

This challenge bundle will help you track Roth IRA contributions during the year to max out this important investment account.

There are 14 different options included in this money savings challenge to help you plan and invest money to max out your Roth IRA!

These Roth IRA trackers can be used physically or digitally to help you keep track of your contributions.

They are set up for weekly contributions throughout the year in order to max out your Roth IRA contributions.

Roth IRAs Recapped

Some key notes to remember about Roth IRAs:

- A Roth IRA is a type of retirement account where you pay taxes on money before you put it into your account and then all future withdrawals from the account are tax-free.

- There are income limits for who can contribute. If you make too much money you can’t utilize a Roth IRA without doing more complicated strategies.

- Each year there is a max for how much you can contribute. This amount changes every couple of years. In 2022, the contribution limit for a Roth IRA was $6,000 a year. For age 50 or older you could deposit extra money to “catch up” with contributions up to $7,000. In 2023 those amounts changed to $6,500 and $7,500.

- You can start a Roth IRA at most brokerage firms, banks, and investment companies. Personally I use M1 Finance and Vanguard.

- A Roth IRA can be established at any time. You have until that year’s tax-filing deadline, usually April 15 of the following year, to max out your contributions.

- You can put money in your Roth IRA for as many years as you want as long as you have earned income that qualifies.

- You can withdraw contributions from your Roth IRA, both tax- and penalty-free if you take out only an amount equal to what you’ve put in.

- For withdrawing earnings in your Roth IRA, the current rules say that as long as you’ve owned your account for 5 years and you’re age 59½ or older, you can withdraw your money and you won’t owe any federal taxes.

- There are not required minimum distributions like a traditional IRA that forces you to pull out money beginning at age 72.

You can learn more about Roth IRA rules on the IRS website or any brokerage that offers Roth IRAs.

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.