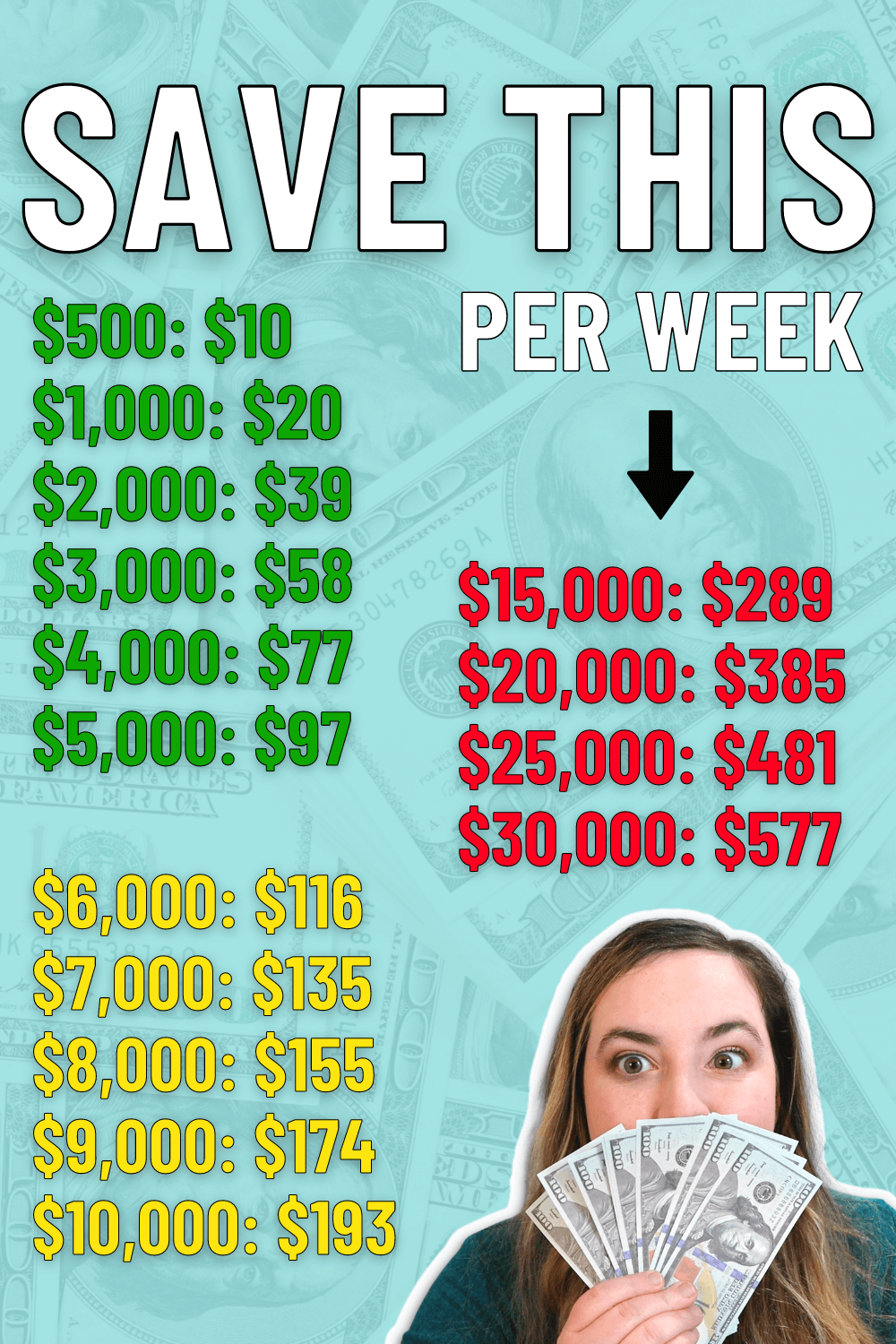

Are you looking to save a specific amount of money this year? Whether your goal is $500 or $30,000, it’s easy to figure out how much you need to save per week to reach it.

Here are the most common savings goals and the weekly amounts you need to save in order to reach them.

You can watch the savings goals video above or keep reading for the list and savings tips!

Savings Goals: $500 to $10,000

Are you aiming to save less than $10,000 in one year? These savings goals are very achievable when you save money on a weekly basis.

Below are the amounts you need to save per week in order to hit your savings goals from $500 to $10,000.

- $500: save $10 per week

- $1,000: save $20 per week

- $2,000: save $39 per week

- $3,000: save $58 per week

- $4,000: save $77 per week

- $5,000: save $97 per week

- $6,000: save $116 per week

- $7,000: save $135 per week

- $8,000: save $155 per week

- $9,000: save $174 per week

- $10,000: save $193 per week

These amounts are fantastic to save during one year.

With these amount you can fund a Roth IRA, fill an emergency fund, or pay for a great vacation.

Want to save $10,000 in one year? This savings challenge tracker is perfect for you! This $10,000 Money Saving Challenge is designed to help you save up $10,000 over one year with either one of the two different savings plans.

Higher Savings Goals: $15,000 to $30,000

If you want to put away even more money then you will be saving more per week.

These are the amounts you need to save weekly in order to save from $15,000 to $30,000:

- $15,000: save $289 per week

- $20,000: save $385 per week

- $25,000: save $481 per week

- $30,000: save $577 per week

These amounts of money can help you build a downpayment, prepare for a job change, buy a car or more.

How To Make Saving Money Work for YOU

To make saving even easier, consider setting up automatic transfers to your savings account each week.

For many people it is easier to have the savings transferred automatically so you only budget with the money leftover after you save.

Alternatively, you can use a manual method, such as a savings challenge tracker or other visual savings tracker, to help you stay on track.

Many of the savings challenges in our shop provide weekly savings amounts you can implement through the year. These visual trackers help many people stay on track throughout the year.

Want to save $20,000 in one year? This savings challenge tracker is perfect for you! This $20,000 Money Saving Challenge is designed to help you save up $20,000 over one year with multiple different savings plans.

More Tips for Saving Money

Saving money is a common financial goal but it can be difficult.

Here are a few tips for saving money that can help you meet your savings goals:

- Create a budget focused around your savings plan so you can pay yourself first.

- Use a high yield savings account to earn additional interest.

- Round up to the nearest dollar when calculating your weekly savings amount to give yourself a cushion towards your goal.

- Consider using a visual tracker or savings challenge to stay motivated and on track.

- Watch motivational savings content online like Transfer Tuesdays.

- Set up automated transfers for your savings if you know the money will be there each week at the same time.

- Find ways to cut costs in your budget so you can send more money to savings.

- List out your favorite financial affirmations to keep your money mindset positive while saving for 52 weeks.

Start saving towards your goal today and you’ll be amazed at how quickly you can reach it!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.