Investing can be intimidating so a lot of people put it off until too late. It’s better to find investment tips for beginners and start early than wait.

If you’re not investing, especially if you are a woman, then you are losing ground financially.

Today we are going to talk about our personal investments, tips for newbie investors, and why the amount of time your money is invested matters more than picking the perfect stocks.

How I’m Investing For The Future

I generally do not share our investments because as a family we decided not to share that information.

However, I get a lot of questions about investing. Every time I publish a budget video people ask if I’m investing or not. I finally realized not discussing investing our money is doing y’all a disservice.

If you have always been curious about our investments, keep reading because today I am sharing all the details.

Remember that this is what we are doing for our own wealth building. In the video below I share a few investing beginner tips, but I’m not a financial advisor. Remember that this is just my own personal experience. Please remember this is for inspiration and motivation to get started – not expert financial advice.

Our Investment Accounts

I actually have been investing since the age 21 when I opened up my very first investment account – a Roth IRA. When I was in college I had very little idea what I was doing. I knew investing and compound interest would help my money work for me. I researched online and found that a lot of people suggested opening accounts at Vanguard so that’s what I did!

Fast forward over a decade later and as of today, we actually have 6 different investment accounts. SIX! So I’m going to walk you through them and the purpose for each.

Roth IRA

I started a Roth IRA when I was 21 before I graduated college. I participated in a gameshow at my school and answered an easy investing question wrong because I was nervous on stage due to a fear of public speaking. That made me feel so dumb the next day I decided to do something to prove I was actually smart with money.

With that experience in mind, I opened up a Roth IRA at Vanguard. I started with $1,000 I’d earned from working and I have contributed yearly since then. This turned out to be a good decision! Most of my jobs did not offer retirement investing plans so getting started on my own saved me. The account actually took a nosedive when I graduated into a recession but I kept contributing. Because of this it grew a ton in the last few years of great stock market returns. The majority of this account is in mutual funds and target date funds.

Learn more: Roth IRA 101

Mary’s 401K

I opened my first 401k 3 years ago when I started working at my current job. Until then I didn’t have access to one at any of the places I had previously worked. Since my company has a 4% match I’ve contributed up to the match every month since I’ve been eligible. Apparently I was one of only a few who contributed at all despite the match and I was bugging my HR person the instant I knew I was eligible. I still contribute to my 401k to get the match and will not stop as long as I have the option, debt or no debt. Our company uses Guideline for our 401k and I have a “Young Professionals” portfolio that is majority invested in the stock market in broad funds covering the S&P 500.

Learn more: Retirement Savings 101

Jason’s 401K

My husband has a 401k that he also contributes to every single paycheck. His company also provides a match. His company matches less than my company does but there is no reason not to take it. He also had a 401k from his previous job. His 401k is invested in Vanguard mutual funds within the company’s 401k program.

Learn more: Where To Open A Roth IRA

SEP IRA

I have a SEP IRA with Vanguard as well. The long name is Simplified Employee Pension Individual Retirement Arrangement and this is just a type of account that allows self-employed people to provide retirement benefits to themselves and employees.

I started this account when I was freelancing and started earning online income. I’ve sporadically contributed part of my profits in order to save for retirement and reduce my taxable income. I would like to contribute more consistently to this account, especially after I’ve tackled the debt we are paying off. Since I currently use my business income to pay off debt and reinvest in the business I do not contribute much to this account.

Learn more: How To Start Dividend Investing For Beginners

Penny’s 529

Each month we invest into a 529 plan account in order to save for our daughter’s college education. A 529 plan is a college savings plan that offers tax and financial aid benefits. We currently save $25 a month into this account. That doesn’t seem like a lot but we have family contributing as well. Since she is a toddler we feel like we are in a good place with this investment.

Ellevest Account

This is the most recent investment account I opened. I started this account in October 2019 after meeting some of the Ellevest team at FinCon. I had been looking for a place to invest some for medium term range goals. These are things like buying a new house for a better school district. Ellevest seemed like the perfect fit for my situation because you invest based on the goals you want to achieve. I opened this account with a minimal amount since they allow you to open accounts for just $1.

And that is it!

Our Investment Tips & Plan

Those are all the accounts we have currently and why we use them for our investing! It seems like a lot but I try to take advantage of all the options available to me. I know that investing my money is the key to financial security in the future.

I knew early on I would have to be responsible for my financial future. When I learned not all jobs had 401ks or pensions, I knew I had to invest more. Of course, I knew nothing about what that actually meant and had to teach myself the whole process. I read a ton of blogs and learned how I could easily start investing with Vanguard and it has grown from that very first investment over 10 years ago. I still watch a lot of videos about investment options and the investments other people are making.

Unfortunately most of the investment bloggers and YouTubers I watch are men and we women don’t share much about our investments or stock picks. I don’t share much about my investments like these channels because my investment style is not exciting. I only check my balances quarterly and rebalance things then if needed. There isn’t much action but I am investing every month because I know that it matters to my future.

Investment Tips For Beginners

Now let’s talk about a few investment tips for beginners if you are new to investing.

If can feel overwhelming hearing that about 6+ investment accounts. Starting to invest as a beginner is all about taking it slow and learning as you go.

Here are some of my best investment tips for beginners:

Investing Tip: Get started now!

How do you start investing and when do you start? The simple answer is as early as you can! Once you are ready, don’t procrastinate or try to learn everything. It’s just too vast and you’ll never learn everything you possibly can before investing. Make the decision to invest, choose a well known company, and just invest some of your money. The best antidote to fear and overwhelm is action. Just get started!

You’ll learn more as you go along but the most common problem I see is people delaying their investment start date because they feel overwhelmed or are scared to make the right decision. Let this go, make the first decision, and implement it even if it’s just with a small amount like $10 a month or even $1,000 dollars to start an account. Perfection is not required to get started. You will learn and grow just by the action of sending money to an investment account.

Learn more: Where To Open A Roth IRA

Investing Tip: Pay off high interest rate debt before investing.

Side note: some people don’t invest while they are in debt and some do. This decision really matters most on what works for your personal situation and timeline. Personally we have slowed our investments down but still take advantage of our 401ks at work to get our matched amounts from our employer.

If you decide to wait to invest and tackle debt first make sure your debt payoff plan is fast and furious and won;t stretch out for a decade. If you’re on the fence, a good rule is to pay off all high interest debt before you invest. Any credit cards or loans above 10% interest rates need to be a priority to eliminate asap.

Learn more: 10 Tips To Pay Off Debt

Investing Tip: Learn as you go.

The great thing about investing is that these accounts are not locked in stone, so you can learn as you go and make changes when you are better educated. There are many great ways to learn about investing, from watching videos here on youtube to reading financial websites to meeting with a financial advisor.

When you are getting started, pick an investing platform like Vanguard to use and then just go with it. Learn about it and how to use it. If you don’t like it then you can always pull it out and change it to another company.

One great way to learn is just buy experience with investing. For example, I learned not to pull out investments when the markets tank. It’s easy to hear this often repeated phrase, but the experience of going through it with my accounts and watching the money “disappear” then come back strong when the economy recovered was a great education. You can also watch many people invest right here on YouTube and see how they are doing with their portfolios since they show exactly what they are invested in and the ups and downs of investing.

Learn more: 25 Tips I’ve Learned From The Debt Free Community

Investing Tip: Change your mindset.

What is the least amount of money you can invest? At Ellevest, it’s a penny. Seriously, there are companies out there now that are super approachable because they know traditional platforms have turned off people that don’t have piles of cash to invest.

I’m happy I got started investing at a younger age but I’m amazed at how so many of the barriers that existed then are gone. I have to wait til I had $1,000 saved up to invest and today you can start with $1. Investing shouldn’t feel scary when you are starting small and learning as you go.

This is HUGE because the biggest problem I see with women and investing is being scared to start or not wanting to make the wrong choice. In the back of our minds we run through all the messages we’ve received from society and likely our own upbringing about how “we’re not good at math” “were not good at money” “were not good at investing” “were not good at taking risks”, but that’s not really true. It’s just the messaging sent to us.

If you have those mental roadblocks to investing, think of it as “this is an opportunity” not a “risk. Think of it as a way to create a sense of abundance in your life and create wealth to help your family, not a potential way to lose money. Changing your mindset can be very hard but it’s essential to continued growth and building wealth.

Learn more: 10 Ways To Take Control Of Your Finances

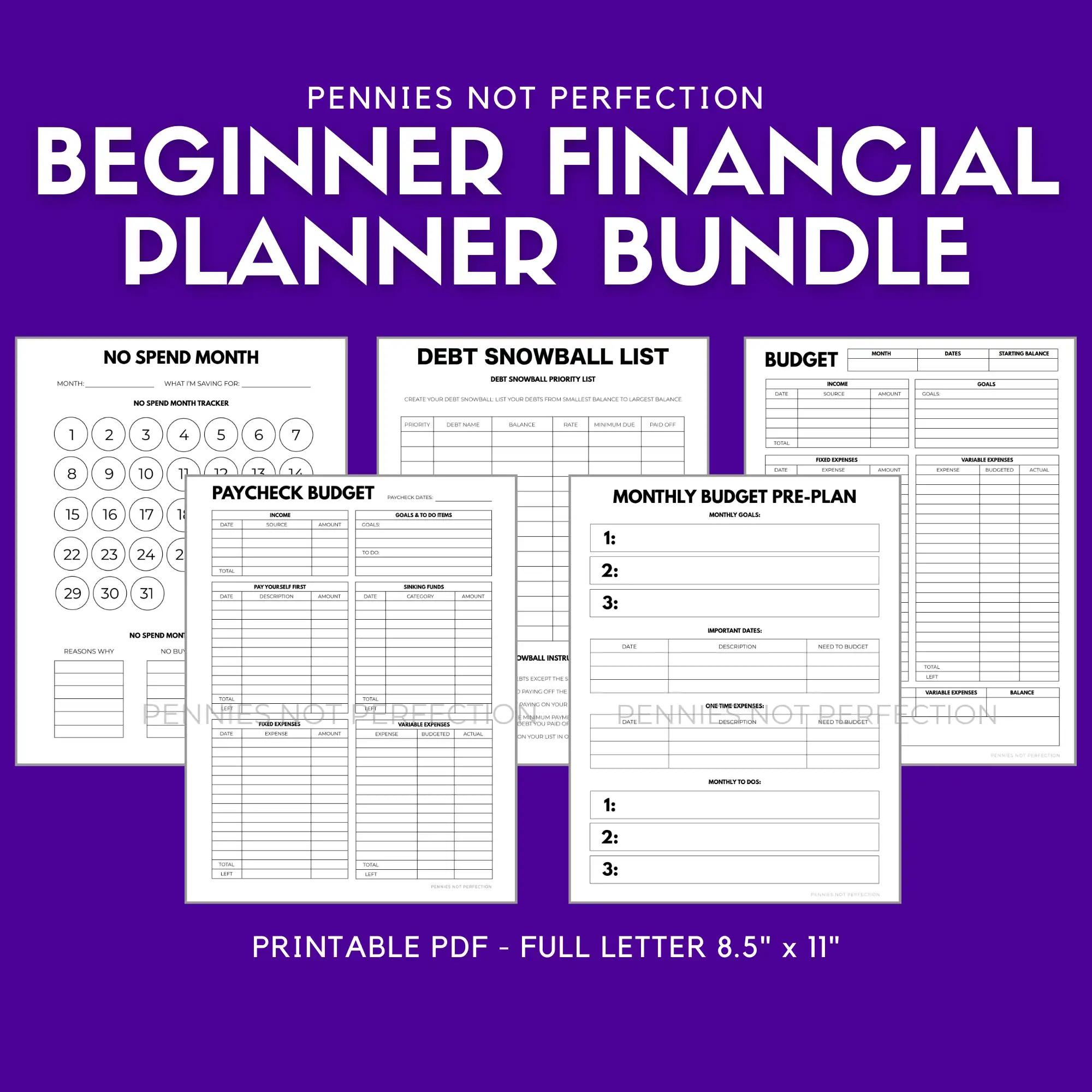

This financial planner bundle is a grouping of everything you need to plan your budget, grow your savings, and achieve your debt payoff. It is perfect for anyone who wants an all-in-one solution to get started and get organized!

Now that I’ve spilled the behind the scenes of my investing life, I’d like to know, do you invest? What are you investing for? What would you like to know about investing?

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.