Are you looking for a 52 week money challenge with $10,000 as a savings goal? You’ve found it!

Using a money savings challenge can help you save up $10,000 in 52 weeks for whatever goal you have from an emergency fund to a down payment.

Each week you save the amount listed and after 52 weeks you’ll have $10,000 saved up.

Could you use an extra $10,000 in a year? Would it help you buy a home? Send your child to college? Fund an early retirement? Just having an extra $10,000 saved allows many people to dream of new possibilities.

Why Do A 52 Week Money Challenge?

Saving money can be hard for many people especially when the amounts get larger. Doing a 52 week money challenge to save $10,000 allows you to strategically save up the amount over a year.

Here are some of the benefits from doing a year long money challenge:

- The saved money. Obviously the amount of money saved up at the end of the challenge is the main benefit. Having your money goal reached is a huge benefit to doing a money saving challenge.

- Improved relationship with savings. For many people a savings challenge can help them improve their relationship with money and saving it. If you’ve always spent every dime you had available a money challenge might be the thing to change that tendency. You will also be creating a new or better habit of saving.

- Improved discipline. Saving money is hard. I run a personal finance blog and I still struggle with saving money sometimes because it’s much more fun to spend. Savings challenges can help with this because they force you to be more disciplined with money. Forcing yourself to start and finish the challenge means you’ll develop good routines and discipline over 52 weeks.

52 Week Money Challenge $10000 Printables

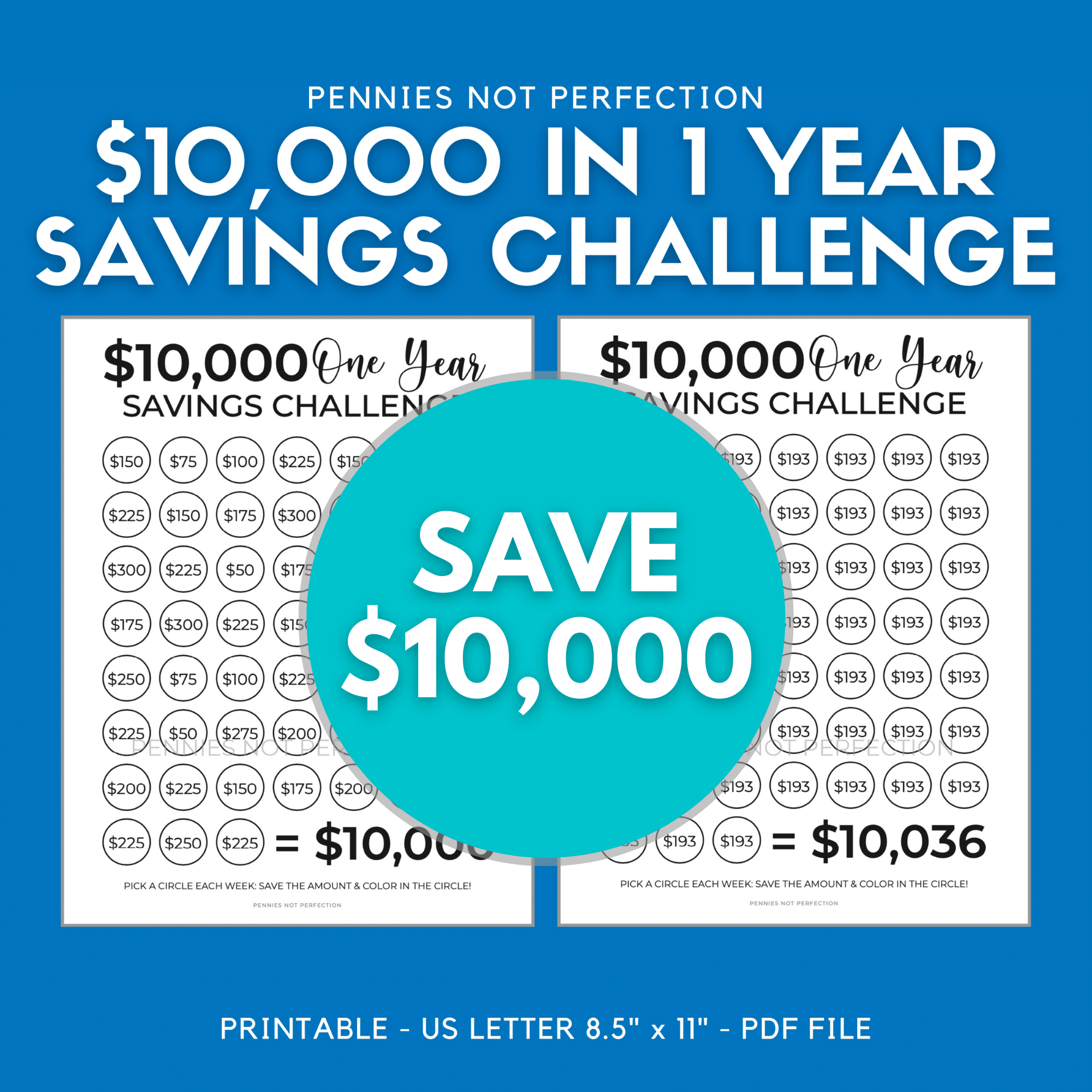

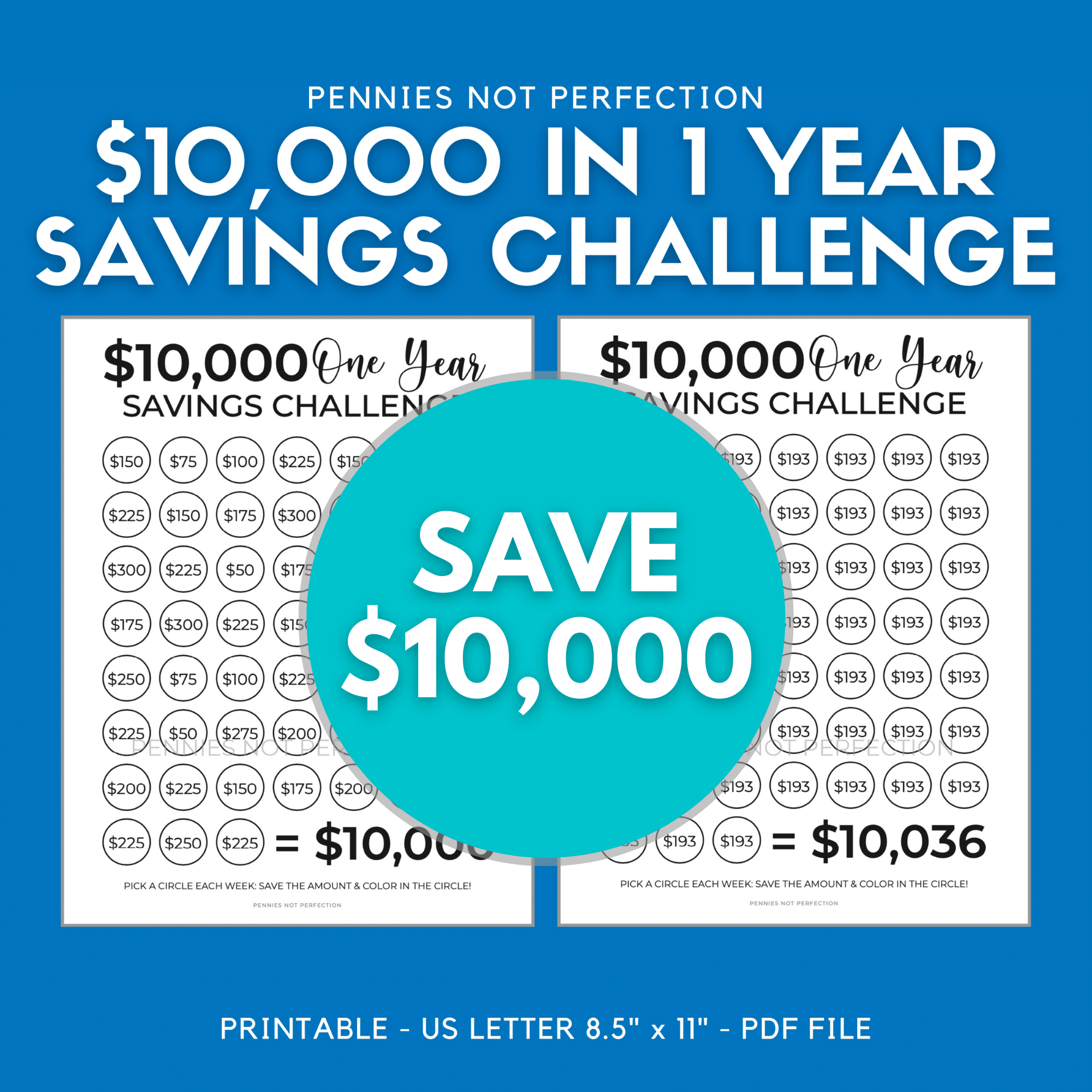

There are multiple 52 week money challenges available in my money printables library bundle but the most popular is this $10,000 in 1 year savings challenge.

You can get the 52 Week Money Challenge $10000 printable in the Pennies Not Perfection shop. It’s designed to give you a certain amount to save each week so you have $10,000 at the end of 52 weeks.

There are TWO different options included in this money savings challenge:

- $10,000 money savings challenge tracker with random amounts to save each week

- $10,000 money savings challenge tracker with the same amount to save each week for slightly over 10K

It’s a PDF file you can download, print, and use again and again. Or you can also upload it to apps like GoodNotes to use digitally.

Personally I’ve found printing the challenge and putting it up somewhere you see it daily can be very motivating!

Want to save $10,000 in one year? This savings challenge tracker is perfect for you! This $10,000 Money Saving Challenge is designed to help you save up $10,000 over one year with either one of the two different savings plans.

Starting A 52 Week Money Challenge

Many people start savings challenges in January when they are making financial goals and resolutions to save money money.

However you can start a 52 week money challenge at any time!

Regardless of when you start you’ll have saved up $10,000 a year from that beginning.

When you start you can follow the challenge in order that the amounts are printed or you can tailor the challenge to fit your lifestyle.

If you know that January will be your best month then choose some of the higher amounts for each week. Or if you know you get a large bonus in December then maybe start out with the smaller amounts and work up to the bigger numbers.

Like most financial changes the most important part is that you get started. It doesn’t have to be on January 1 and it doesn’t have to be the “perfect” time.

You just have to start and be consistent each week.

Money Challenge Tips For Success

After completing multiple savings challenges I’ve found there are a few ways to make sure you are successful. The list of ideas below are tips to help you successfully save during the 52 week challenge.

Follow a savings plan.

Having a clear savings plan with exact numbers to save during the year makes you much more likely to succeed.

That’s why I offer a $10,000 in 52 weeks savings challenge printable. It gives people a clear plan to follow.

If you prefer to find another plan there are also many free 52 week money challenges available online. No matter which you choose, commit to following the savings plan for the whole 52 weeks.

Budget your money.

It’s possible to spend your entire income no matter how high that income grows. Budgeting your money and knowing how much you have going in and out of your account is critical for success with a money challenge.

There are many different ways to budget from paycheck budgeting to anti budgeting.

Finding the right method for you over the 52 weeks will help make the challenge successful and set you up for a lifetime of good money management.

Pick a day of the week to make contributions.

Making your contributions on the same day every week is a great way to keep yourself consistent and accountable. When you always contribute on the same day you are much less likely to forget about your savings challenge.

I personally do this with my Transfer Tuesday series on YouTube (feel free to subscribe and join me).

Use a high yield savings account.

When you are completing a money challenge you want to put your somewhere safe that earns a little bit of money. Using a high yield savings account (or the M1 Finance spend account) can accomplish this.

You’ll earn a bit of money while working on your 52 week challenge but it won’t be at risk by being invested in the stock market.

Keep yourself motivated.

Making sure you are motivated and stay motivated is the best way to successfully complete a money savings challenge. You can do this in a number of ways based on what motivates you best.

Maybe it’s having your challenge printed and in a visual places so you can see it daily. Maybe it is accountability so you have to check in each week. Finding the motivation techniques that appeal to you will help with your success.

Plan for potential setbacks.

You will likely have some setbacks or difficult times during your year long challenge. Making a plan for this and knowing what you will do can help.

For example, maybe you know that you’ll have a large expense during the year. You can plan to contribute smaller amounts for the challenge during that time. Instead of giving up, plan around things that come up or make changes.

Remember it’s also ok to pause the challenge and pick it up again when you can. In the end if doesn’t matter if your 52 weeks are consecutive or not – you’ll still have $10,000!

Money Making Ideas To Save More

Completing a big $10,000 savings challenge can be difficult and you might need to make more money to reach your goal.

Below are some ideas to help you make money over the next 52 weeks as you work on your money challenge.

- Make money using Canva design software

- Side Hustle Idea: Sell stickers on Etsy

- How to start a reselling side hustle

- Side hustles ideas for moms

- Make money with A YouTube channel

- More ways I make money online

These ideas can help you earn a little bit of extra money throughout the year while you complete your challenge. You can do it!

Mary is the founder of Pennies Not Perfection where she shares her journey to build wealth through online income. She quit her day job in 2021 after she paid off her debt and doubled her 9-5 salary.

Mary's favorite free financial tool is Personal Capital. She uses their free tools to track net worth and work toward to financial freedom.

Her favorite investment platform is M1 Finance, where she built a custom portfolio for free with no fees. She shares her portfolio growth and savings progress every month on YouTube.